Since lenders face heightened competition and a tougher operating environment in 2016, Fannie Mae surveyed lenders to see how they plan to outpace their competition and thrive in today’s evolving lending market.

Fannie Mae predicts that lenders will have to deal with rising mortgage rates and the Federal Reserve increasing the federal funds target, resulting in total single-family mortgage originations dropping about 11% this year to $1.51 trillion, thereby elevating lenders' competitive pressures.

However, trends in home sales, home prices and homebuilding activity will continue to be positive this year.

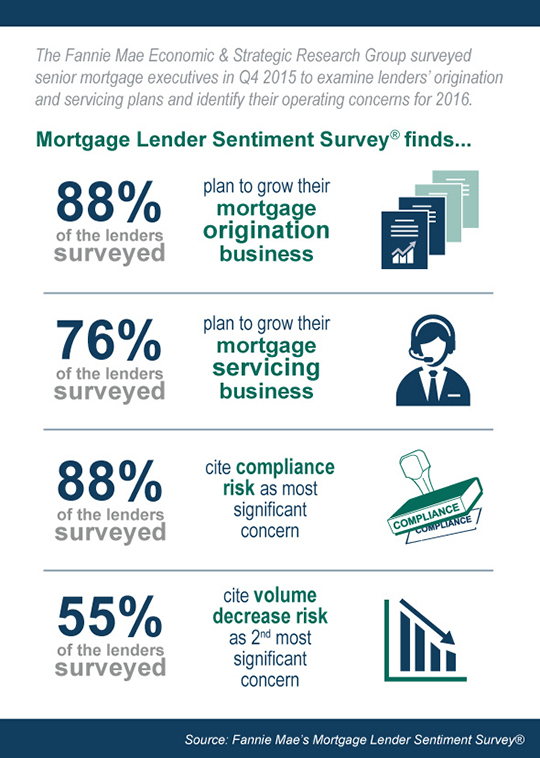

Fannie Mae's Economic and Strategic Research Group surveyed senior mortgage executives in November 2015 through its quarterly Mortgage Lender Sentiment Survey.

According to the survey, 88% of the lenders reported that they are looking to grow their mortgage origination business.

In order to do this, lenders cited:

- Increasing the number of retail branches/loan officers

- Expanding marketing outreach

- Put a heavier emphasis on attracting new borrower segments

- Expanding Direct-to-Consumer online lending capabilities

Meanwhile, fewer plan to offer new mortgage products.

This chart presents some of the results, along with lenders top two concerns.

Click to enlarge

(Source: Fannie Mae)