Freddie Mac recorded a fourth quarter net income of $2.2 billion, a jump after net loss of $475 million for the third quarter of 2015, which marked the first loss in four years.

The government-sponsored enterprise also posted a comprehensive income of $1.6 billion, up $2.1 billion from a comprehensive loss of $501 million for the third quarter of 2015.

Benefit for credit losses was $781 million for the fourth quarter of 2015, an increase of $253 million from the third quarter of 2015. The increase primarily reflects an improvement in loss severity and default probability.

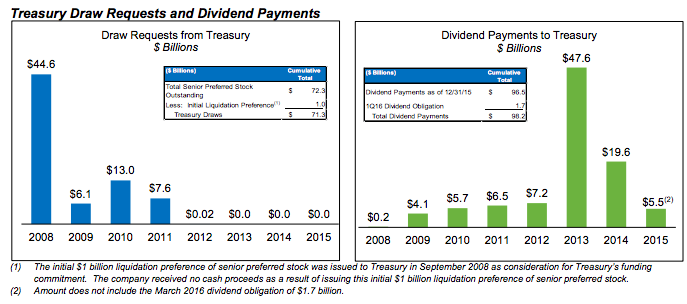

The results said that dividend obligation to Treasury in March 2016 will be $1.7 billion, based on Freddie Mac’s net worth of $2.9 billion at Dec. 31, 2015, less the 2016 capital reserve amount of $1.2 billion.

This chart shows Freddie's dividend obligation over the years.

Click to enlarge

(Source: Freddie Mac)

For the full year, Freddie reported the fourth consecutive year of positive earnings, driven by solid net interest income of $14.9 billion, which was up 5%, despite mandated reduction in mortgage related investments portfolio.

Approximately 45% of net interest income for the full-year 2015 was derived from management and guarantee fees.

Freddie Mac noted that market-related items created quarterly volatility but had minimal effect on full-year 2015 results.

“2015 marked another year of solid financial performance for Freddie Mac – our fourth straight year of profitability, although we did experience significant quarterly market-related earnings volatility,” said Donald Layton, CEO of Freddie Mac.

“Our performance was driven by our progress in building a better Freddie Mac, as evidenced by continued growth in purchase volumes in the guarantee businesses, including a multifamily record for the company. We’re also building a better housing finance system by expanding credit risk transfer and efficiently disposing of legacy assets, and so reducing taxpayer exposure to mortgage risk,” he said.

“The mortgage markets have strong momentum going into 2016, and we continue to focus on serving our customers better and fulfilling our mission to support the housing needs of owners and renters nationwide, including responsibly expanding access to mortgage credit,” Layton concluded.