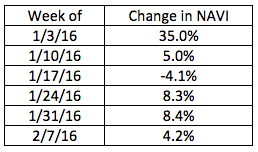

Appraisal volume moved higher for the third consecutive week, increasing 4.2% for the week of Feb. 7, the most recent report from a la mode, an appraisal forms software company that tracks appraisal volume throughout the country, showed.

This is up from 8.4% for the week of Jan. 31 and 8.3% for the week before that.

Click to enlarge

(Source: a la mode)

“The National Appraisal Volume continued its positive growth with a 4.2% increase over last week. The soft interest rates and stable employment market has encouraged the strengthening housing market,” said Kevin Golden, director of analytics with a la mode.

Zillow recently reported that according to the interest rates borrowers are quoted on its mortgage marketplace, mortgage interest rates are actually lower now than they were before the Federal Open Market Committee announced in December that it is increasing the federal funds rate for the first time since June 2006.

Phil Huff, president and CEO of Platinum Data, commented on the report saying, “Lower rates are only the first part of the story. This mini-boom is fueled by near-missed opportunities. A lot of folks thought they’d missed the last refi boat, so they’re rushing to refinance now that the refi boat made an unexpected return. Time and regret are a great impetus for acting on lower rates.”

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.