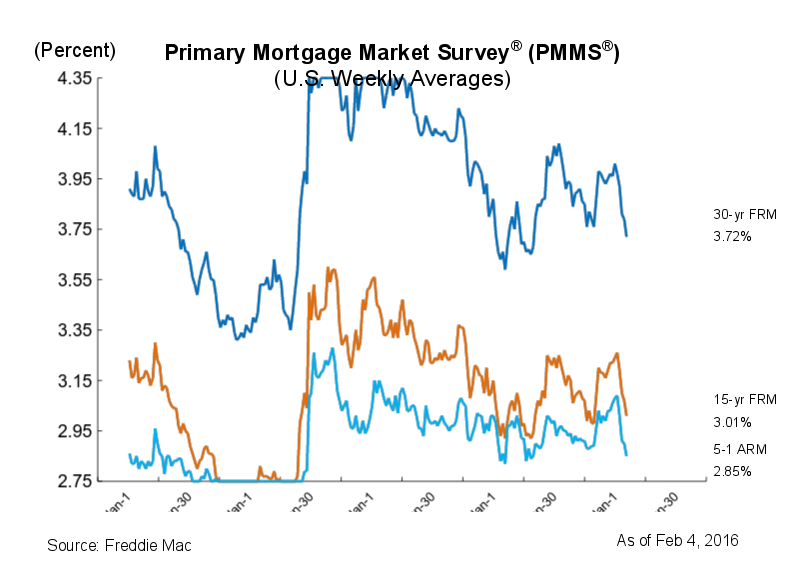

Mortgage rates sank even further, marking the fifth consecutive week of declines amid ongoing market volatility, the latest Freddie Mac Primary Mortgage Market Survey said.

The 30-year fixed-rate mortgage declined to 3.72% for the week ending Feb. 4, 2016, down from last week when it averaged 3.79%. In 2015, the 30-year FRM averaged 3.59%.

This is its lowest point since the week of April 30, 2015 when it averaged 3.68%.

Additionally, the 15-year FRM this week came in at 3.01%, down from 3.07% last week. A year ago at this time, the 15-year FRM was at 2.92%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.85% this week, down from 2.90% last week. A year ago, the 5-year ARM averaged 2.82%.

Click to enlarge

(Source: Freddie Mac)

“Market volatility—and the associated flight to quality—continued unabated this week,” said Sean Becketti, chief economist with Freddie Mac.

“Both the Treasury yield and the mortgage rate now are in the neighborhood of early-2015 lows,” said Becketti. “These declines are not what the market anticipated when the Fed raised the Federal funds rate in December. For now, though, sub 4% mortgage rates are providing a longer-than-expected opportunity for mortgage borrowers to refinance.”

According to an article in MarketWatch by Anora Mahmudova, "The 10-year U.S. Treasury yield hit a one-year low on Wednesday—a sign the market believes that interest rates will remain lower for longer."

Zillow’s latest report on the interest rates borrowers are quoted on its mortgage marketplace posted similar news, showing that during the last week, mortgage interest rates hit their lowest level since 2013.

Despite some predictions that mortgage interest rates would rise in the aftermath of the Federal Open Market Committee’s December announcement of an increase to the federal funds rate for the first time since June 2006, the exact opposite has happened, with interest rates falling to a two-year low, according to Zillow.