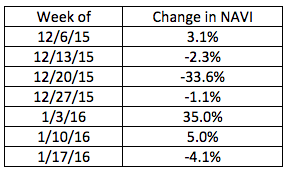

Appraisal volume erased most of last week’s rise, falling 4.1% for the week of Jan. 17, the most recent report from a la mode, an appraisal forms software company that tracks appraisal volume throughout the country, showed.

A week ago, appraisal volume grew 5%, following a strong surge the week prior.

Click to enlarge

(Source: a la mode)

“This week’s drop adds to the confusion of how well the economy and particularly the housing market is doing,” said Kevin Golden, director of analytics with a la mode.

“While appraisal volume started the year with a strong recovery from the Christmas and New Year slump, it has not seen the energy that mortgage applications have shown. This is perplexing but could be because of lenders still getting used to the new TRID procedures and delaying ordering appraisals or just that the applications are falling out and not turning into mortgages,” he continued.

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness has been approved and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.