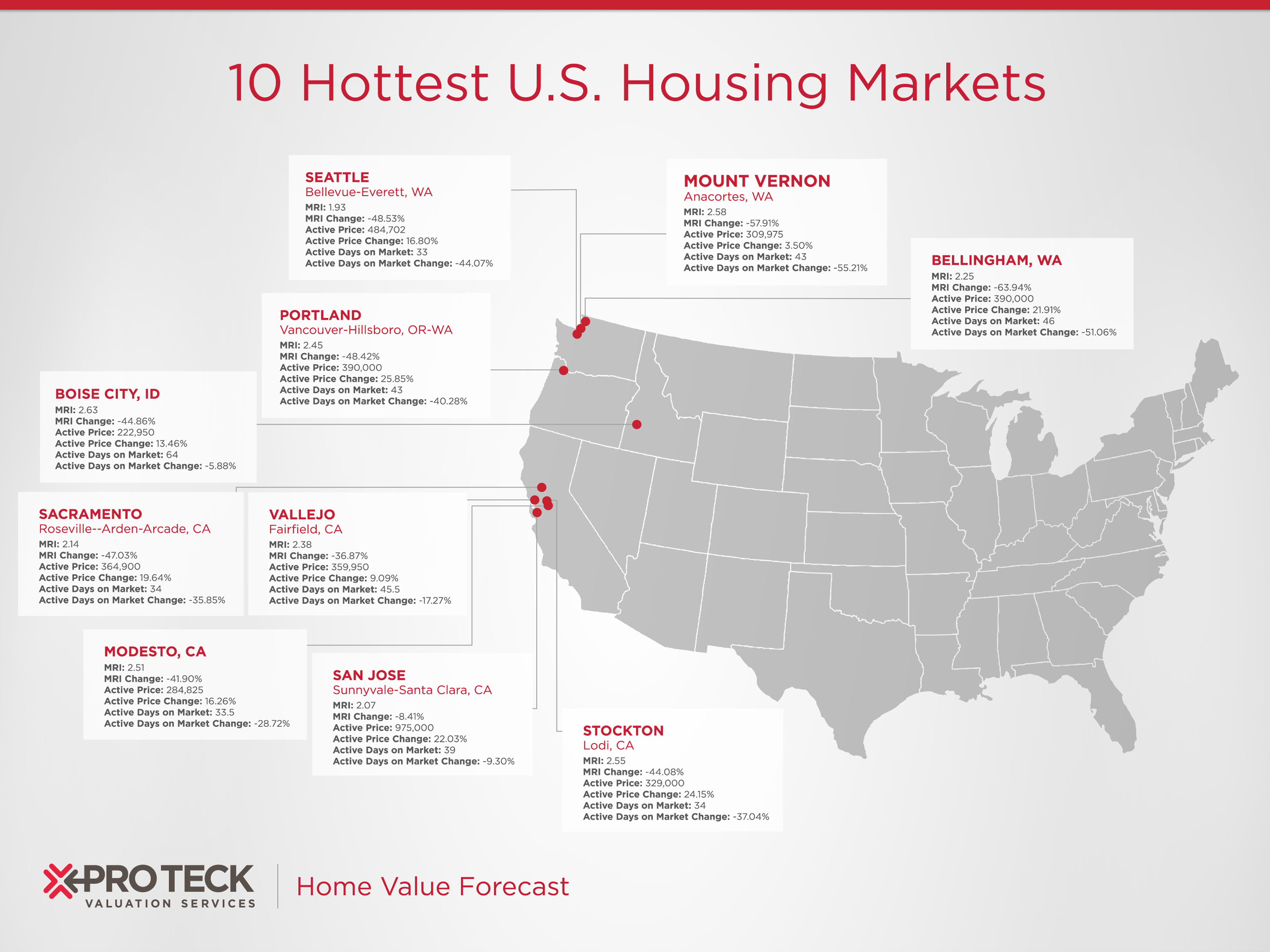

The West Coast has dominated the top ten real estate market list for many months now, causing some people to be concerned that these market are overheated.

Pro Teck Valuation Services November Home Value Forecast update looked deeper at these top ten markets to better understand the reasons behind the data.

Here’s a chart of the 10 hottest U.S. housing markets:

Click to enlarge

(Source: Pro Teck)

To begin, Pro Teck analyzed the price history and collateral analytics forecast for all ten markets. This resulted in the following findings:

- 4 out of the 10 CBSAs —Bellingham, Portland, San Jose and Seattle—are now at all-time highs

- 2 out of the 10 CBSAs— Boise and Mount Vernon—are forecasted to hit new highs by Q1, 2017

- 4 out of the 10 CBSAs— Modesto, Stockton, Sacramento, Vallajo—are not forecasted to exceed pre-crash highs in the next five years

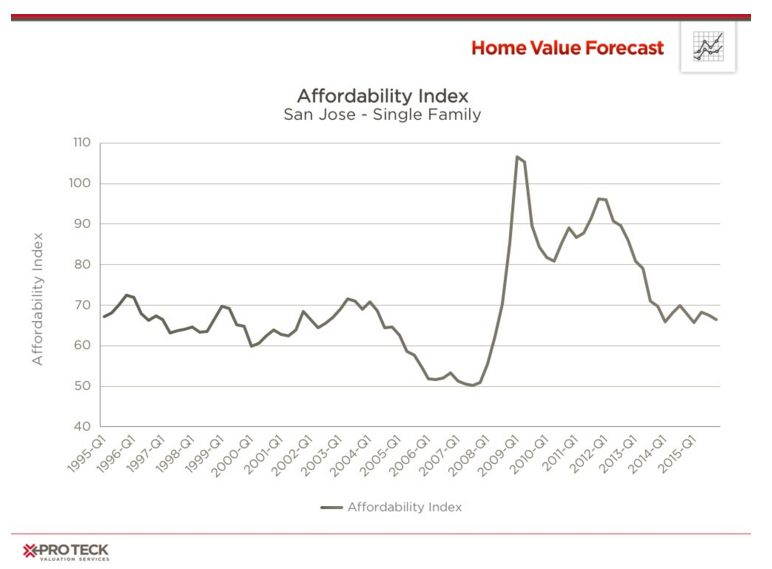

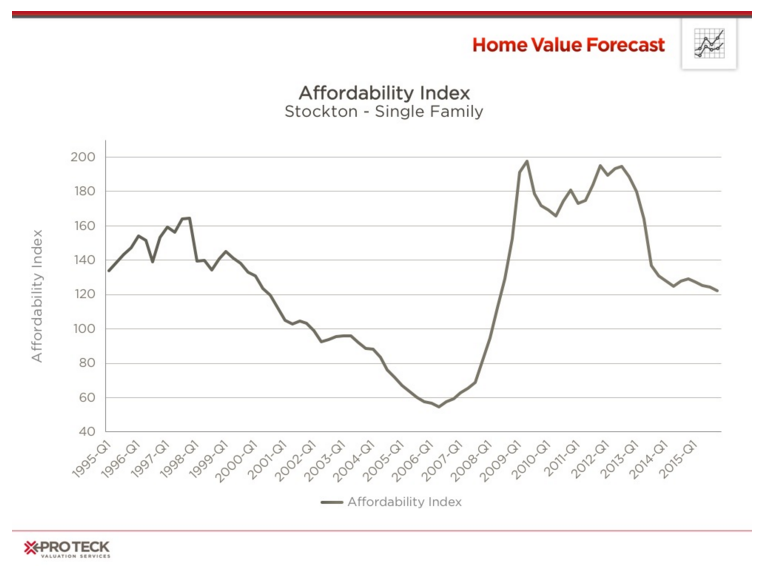

While a bubble can be made up from a compilation of factors, the report explained that one of the most important factors is home affordability.

“Affordability is derived by looking at the median income for a particular area as a ratio to the mortgage payment needed to purchase a median priced home. An index score above 100 signifies that a household earning the median income has more than enough income to afford the mortgage,” the report stated.

Here are two charts spotlighting San Jose and Stockton, California.

Click to enlarge

(Source: Pro Teck)

Click to enlarge

(Source: Pro Teck)

Currently, San Jose has returned to averaging around 70, showing that income has increased to meet historic norms for the area. This isn’t a cause for concern unless it drops into the 50s like it did 2005-2007.

On the other hand, Stockton has been a more affordable place to live, averaging an index over 100 until 2001. It has averaged slightly above 120 ever since 2013.

So as far as a possible a housing bubble is concerned, Pro Teck said, “The above are examples of what we see for all of our top ten CBSAs – while home prices are increasing, affordability is at or above historic norms and nowhere near ‘bubble’ territory of 2004-2007.”