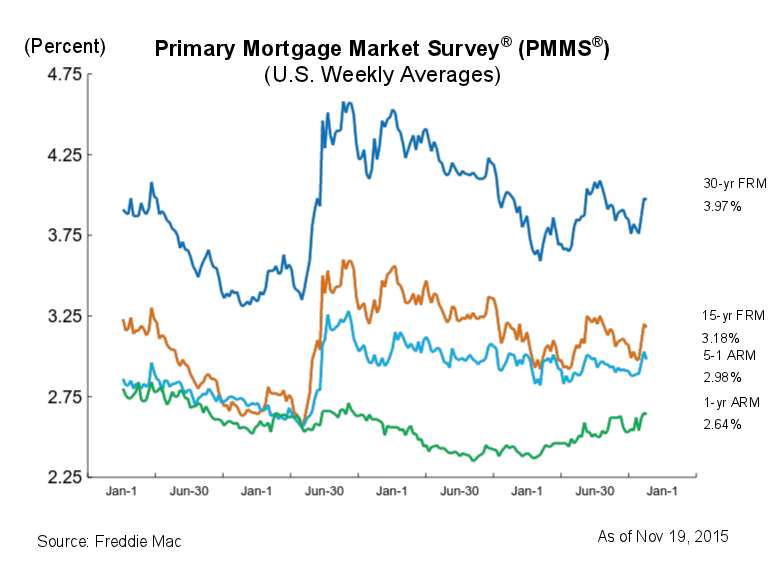

Mortgage rates barely wavered after a recent upward trend, according to the results of Freddie Mac’s latest primary mortgage market survey.

The 30-year fixed-rate mortgage averaged 3.97% for the week ending Nov. 19, down from last week when it averaged 3.98%. Last year, the 30-year FRM averaged 3.99%.

Similarly, the 5-year FRM this week averaged 3.18%, slightly down from last week when it averaged 3.20%. In 2014, the 15-year FRM averaged 3.17%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.98% this week, compared to 3.03% last week. A year ago, the 5-year ARM averaged 3.01%.

The 1-year Treasury-indexed ARM averaged 2.64% this week with an average 0.3 point, down from 2.65% last week, but up from 2.44% last year.

Click to enlarge

(Source: Freddie Mac)

“Treasury yields stabilized about 5 basis points below last week’s level as the market shrugged off economic data and world events and turned its attention to the minutes of the October FOMC meeting,” said Sean Becketti, chief economist with Freddie Mac.

“In response, the 30-year mortgage rate ticked down a basis point to 3.97 percent. The FOMC minutes were couched in careful Fed-speak, and early market reaction was mixed, with most analysts reading their own expectations into the minutes,” he added.

The latest round of meeting minutes from the Federal Open Markets Committee continued to lay the groundwork for a potential increase to the federal funds rate in December.

According to a report from Reuters, via CNBC, there is a building consensus among the FOMC members toward an increase in the federal funds rate for the first time since June 2006.