Fixed-mortgage rates drastically decreased following a more than disappointing September jobs report, the most recent Freddie Mac Primary Mortgage Market Survey said.

Once gain, rates are below 4% for the 11th consecutive week, including the 15-year fixed, which fell below 3% once again for the first time since April of this year.

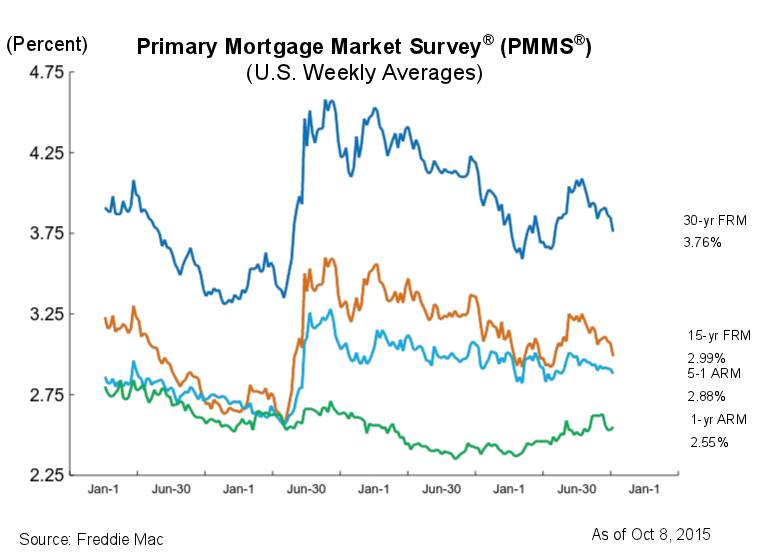

The 30-year fixed-rate mortgage averaged 3.76% for the week ending Oct. 8, 2015, down from last week when it averaged 3.85%. Last year, the 30-year FRM averaged 4.19%.

Additionally, 15-year FRM averaged 2.99%, down from last week when it averaged 3.07%. In 2014, the 15-year FRM averaged 3.36%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.88% this week, falling from 2.91 percent last week. A year ago, the 5-year ARM averaged 3.06%.

The 1-year Treasury-indexed ARM averaged 2.55% this week, increasing from 2.53% last week. At this time last year, the 1-year ARM averaged 2.42%.

Click to enlarge

(Source: Freddie Mac)

“Calling the September jobs report disappointing is an understatement. The sputtering U.S. economy added only 142,000 jobs. To make matters worse, there were downward revisions to the prior two months. Hourly wages were flat, and the labor force participation rate fell to 62.4%, the lowest rate since 1977,” said Sean Becketti, chief economist with Freddie Mac.

“In response, Treasury yields dipped below 2% triggering a 9 basis point tumble in the 30-year mortgage rate to 3.76%.”