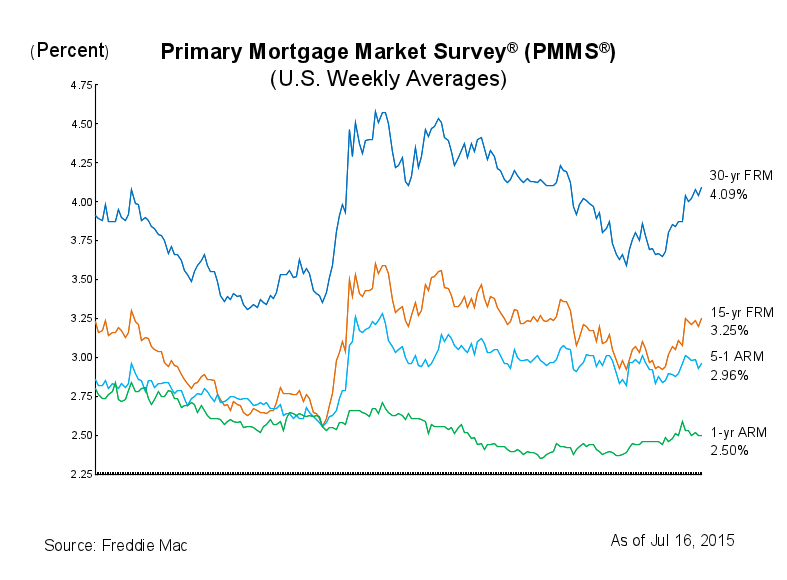

Mortgage rates continued to fluctuate and moved to their highest level this year amid volatility in the bond markets, Freddie Mac’s most recent Primary Mortgage Market Survey said,

The 30-year fixed-rate mortgage averaged 4.09% for the week ending July 16, 2015, up from last week when it averaged 4.04%. A year ago at this time, the 30-year FRM averaged 4.13%.

The 15-year FRM also increased and grew to 3.25%, up from last week when it averaged 3.20%. In 2014, the 15-year FRM averaged 3.23%.

In addition, the 5-year Treasury-indexed hybrid adjustable-rate mortgage inched higher to 2.96%, up from last week’s 2.93%. A year ago, the 5-year ARM averaged 2.97%.

The 1-year Treasury-indexed ARM averaged 2.50% this week with, unchanged from last week, but up from 2.39% a year ago.

“The crisis in Greece continues to generate volatility in U.S. Treasury yields. The tentative agreement hammered out last weekend gave investors the confidence to pull back a bit from Treasuries. Rates rose about 16 basis points on the 10-year Treasury from last week. As a result, the average rate on a 30-year fixed-rate mortgage rose 5 basis points this week to 4.09%, the highest level since October of last year,” said Sean Becketti, chief economist with Freddie Mac.

Click to enlarge

(Source: Freddie Mac)