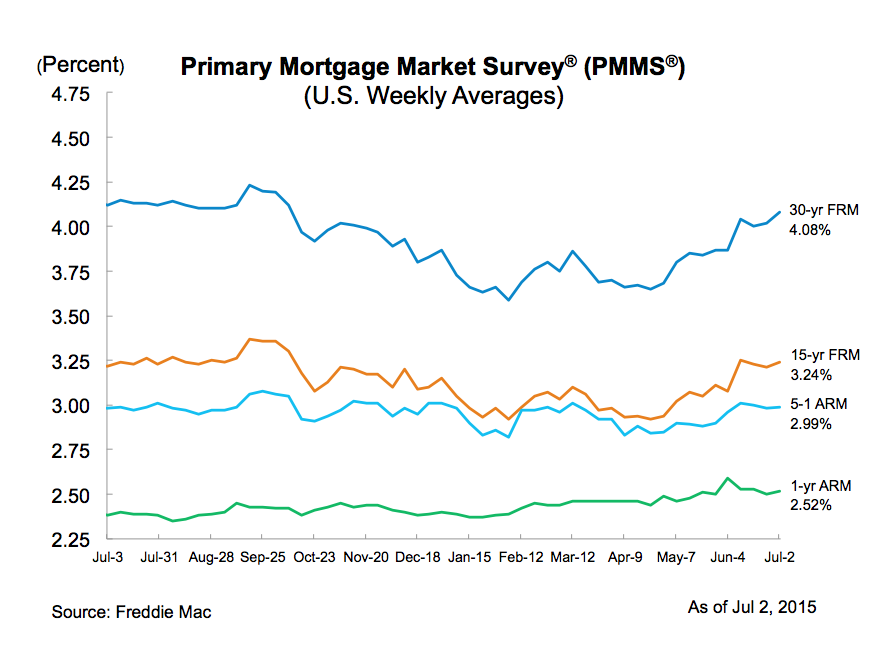

Mortgage rates increased to new 2015 highs moving into the holiday weekend, the latest Freddie Mac Primary Mortgage Market survey found.

The 30-year, fixed-rate mortgage averaged 4.08% for the week ended July 2, up from 4.02% last week. A year ago, it averaged 4.12%.

In addition, the 15-year, FRM averaged 3.24%, up from 3.21% a week prior. In 2014, it sat at 3.22%.

“Overseas events are generating significant day-to-day volatility in interest rates. Nonetheless, the week-to-week impact on most rates was modest—the 30-year mortgage rate increased just 6 bps, to 4.08%,” said Sean Becketti, chief economist with Freddie Mac.

“The (Mortgage Bankers Association) composite index of mortgage applications fell 4.7% in response to what is now three consecutive weeks of mortgage rates over 4 percent. Other measures, however, confirmed continued strength in housing—pending home sales rose 0.9 percent, exceeding expectations, and the Case-Shiller house price index recorded another solid increase,” said Becketti.

The 5-year Treasury hybrid adjustable-rate mortgage averaged 2.99% for this week, a slight increase from 2.98% a week ago. A year ago, it also sat at 2.98%.

The 1-year Treasury –indexed ARM averaged 2.52%, growing from 2.50% last week. The 1-year ARM averaged 2.38% a year ago.

Click to enlarge

(Source: Freddie Mac)

Bankrate posted similar results, with the 30-year, FRM rising to 4.19%, up from 4.16%. A year ago, it was 4.28%.

The 15-year, FRM fell to 3.34%, down from 3.35%, while the 5/1 adjustable-rate mortgage increased to 3.25%, up from 3.23%.