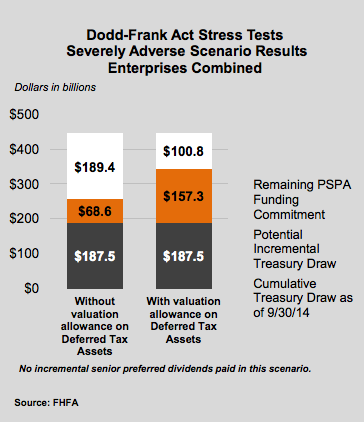

Fannie Mae and Freddie Mac could require between $68.6 billion and $157.3 billion if another crisis were to occur, according to the latest stress test results from the government-sponsored enterprises.

Since Sept. 30, 2014, the enterprises have drawn a combined $187.5 billion from the Department of Treasury under the terms of the Senior Preferred Stock Purchase Agreements.

The stress results give the latest, updated outcomes on possible ranges of future financial results of Fannie and Freddie under severely adverse conditions, which are consistent for both enterprises.

Fannie and Freddie are required to conduct stress tests under the Dodd-Frank Wall Street Reform and Consumer Protection Act. The regulation requires certain financial companies that are overseen by a primary Federal financial regulator and who have total consolidated assets of more than $10 billion, to conduct annual stress tests to determine whether the companies have the capital necessary to absorb losses as a result of adverse economic conditions.

Click to enlarge

Source: Federal Housing Finance Agency