Buyer demand for an easier, tech-assisted mortgage process is getting louder. A recent poll by Discover Home Loans found that nine out of 10 respondents use some sort of online technology to help them with the home financial process, and that trend is only going to grow.

“As technology continues to become an integral part of our daily lives, it’s only natural that buyers also use it to make the home financing process easier,” said TJ Freeborn, senior manager of customer experience at Discover Home Loans. “Not only are homebuyers using the Internet to look at homes and neighborhoods, they’re also using it to submit documents and complete applications online.”

Some of the key findings of the poll:

- 81% said that technology made it easier to share financial information with their lender.

- 69% said technology helped them keep track of important financial documents.

- 36% of homebuyers said that completing the entire financing process online with no phone calls or in-person meetings would make the process easier, but a majority still prefer to have a relationship with their mortgage banker.

- Four out of five homebuyers submitted documents electronically to a lender, realtor or at closing. Of those, nine out of 10 say it was easy to do and saved time.

And these sentiments are even more pronounced when you drill down to millennial buyers. According to Accenture’s Digital Disruption in Banking report, 94% of millennials are active users of online banking, 72% are active users of mobile banking and 92% are active users of social media.

While this shouldn’t surprise anyone, the extent to which mortgage lenders — saddled with legacy processes and faced with declining volumes — can meet this borrower demand is up for discussion.

Rob Chrisman recently ran a piece about this topic on his Daily Mortgage News & Commentary blog, quoting Kristin Messerli, the founder of Cultural Outreach Solutions, a multicultural marketing firm. From Chrisman’s blog:

Rob Chrisman recently ran a piece about this topic on his Daily Mortgage News & Commentary blog, quoting Kristin Messerli, the founder of Cultural Outreach Solutions, a multicultural marketing firm. From Chrisman’s blog:

On the subject of LOs and companies either embracing or ignoring technology, Kristin Messerli, Multicultural Consultant, writes, “Though I hear them repeatedly, today’s remarks made me say yet again, ‘Are you kidding me?!’ The mortgage industry is so far behind in meeting the consumer’s demand for technology, and it appears that there are very few who care. For some to state that technology will simply ‘weed out weak originators’ is reflective of how disconnected the industry really is from technology and the demand of their consumers.

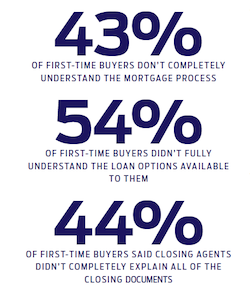

The fact is that technology is the new language of consumers. When you have a customer who speaks Spanish, you provide them with information in Spanish. Today, the majority of consumers speak digital, and yet you avoid speaking our language. Not only is digital our language, but it is also our value. Millennials value quality and efficiency in purchasing decisions. The current process is nowhere close to being efficient. With the passing of the Dodd-Frank, we have regulations in place to ensure quality loan products and disclosures, but we still cannot ensure that consumers are making good decisions and fully understand the disclosures. We simply hope for a good LO. While the CFPB has shortened disclosures, most of them still require a financial literacy rate that is far above that of the average of consumer.

“Additionally, the quantity of disclosures is so extensive that majority of consumers are not capable of processing them appropriately. Good technology puts the consumer in a position to understand in plain language the disclosures…For lenders, it also meets the demand of the buyer for a better mortgage experience. I think mortgage companies will experience another rude awakening if we continue with this idea that people will keep putting up with the industry’s apparent lack of technology adoption for the sake of a ‘good LO’ or ‘solid referral partner.’ We may like you, but we are literally in bed with our technology.

“Ultimately, technology is not about removing the relationship. It is about increasing relationship through proper communication. The industry must start rapidly adopting technology that will increase effective communication before it’s too late.”

Chrisman received a response from a reader, made anonymous here, who disagreed with Messerli’s message:

Chrisman received a response from a reader, made anonymous here, who disagreed with Messerli’s message:

I wonder if the person that is in bed with the technology realizes technology is only as good as the person that inputs the data. Tech is a tool, not an end result.

The comment the CFPB has shortened disclosures verifies this person has NO clue.

Advanced tech tools will not enable the average person to understand the complex world of finance. Unfortunately the opposite has happened. Tech tools such as e-signing make it possible for an individual to sign a document without even seeing the document, let alone reading and/or asking questions regarding what the document encompasses.

I believe the majority of today’s fraud and misrepresentation is done through the Internet/online lenders. No one ever talks to or meets with anyone. Click and move on may be what the younger generations want; but buying a house is not like playing a video game. There are complex issues to understand, and the choices made will make a real difference in an actual life.

Those choices have consequences, like all choices do. With the proper info anyone can make reasonable choices. The excuse I did not know what I signed is not an acceptable response. I make sure my clients know what they have signed.

LO model in place since the 80’s? These people have no sense of history. The current sales person model has been around since products were made and sold. I wish these tech-dependent people luck, when the power goes out.

Messerli responded this way:

(The reader) brings up valid points, but her response is also a great example of the kind of misconception many in the industry have of technology.

First, her point about technology being used to facilitate fraud is the reason why I am passionate about helping to guide tech in the industry, and it is the reason I think people like her need to be part of creating tech that is good for the consumer. I understand why the industry is necessarily timid about using progressive tech in consumer lending, but if good LO’s like herself fall behind in meeting consumer demand, that leaves the not-so-great LO’s to take advantage of technology that isn’t as good for the consumer…

Secondly, while she may feel like she articulates her disclosures well, that is not the case for all LOs. I would like to see the consistent use of technology that ensures all consumers are able to understand their disclosures and are walked through the process appropriately even when their LO is not as careful as she is.

I think there was a misunderstanding about my “shortened” disclosures comment… the Dodd-Frank Act mandated the shortening of disclosures, but I am in agreement that they are still far too complicated, and mostly that the quantity of disclosures make it difficult for even the above-average consumer to process…

Based on reading other responses as well, I think there was a misunderstanding of what I am advocating for. I want the best consumer experience in customer service, ethics, and equality of experience, and I believe progressive technology has the potential to help or hinder this goal. As I said before, technology should not replace a relationship but rather be used as a tool to create a better experience.

There’s no doubt that large swaths of the industry are embracing technology in some form or another, much of it under regulatory pressure. The 2015 HW TECH100, published in the March 2015 issue of HousingWire, recognized 100 companies innovating technology in the mortgage finance industry. The sheer number of firms that applied to be considered for the HW TECH100 was unprecedented, and demonstrates the broad adoption of technology by the industry.

But delivering a satisfying mortgage experience to borrowers is more than just using tech tools in the origination process. It’s a paradigm shift that upends the traditional process and in some ways, puts the borrower in the driver’s seat. Even companies that have implemented digital processes might miss when it comes to translating that into borrower satisfaction.

The most recent J.D. Power Primary Mortgage Origination Satisfaction Study, released in November 2014, revealed that two top concerns for mortgage customers were transparency and consistent communications. According to the survey, satisfaction falls by 236 points (out of 1,000) when loan officers failed to call the borrower back.

These challenges won’t be resolved by an either/or mentality when it comes to personnel versus technology. Lenders need efficient technology and great customer service. Many of the digital processes that lenders are incorporating will help to inform customers and increase transparency, while making the process quicker. But the value of the personal touch — whether it’s a loan officer picking up the phone at the beginning of the loan, or answering questions at the closing table — can’t be overstated.

As the J.D. Power report noted, “While many mortgage customers obtain information and updates online and by using mobile devices, the study shows that the loan representative is still a key part of the equation. Interestingly, some of the most important things lenders can do to deliver a great experience remain heavily reliant on human interaction.”