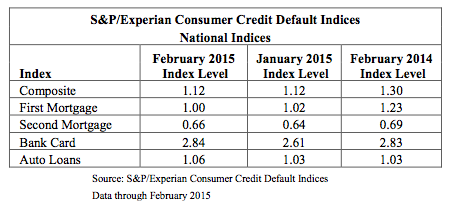

The first mortgage default rate dropped for the first time since July 2014 after months of steady increases, the February S&P/Experian Consumer Credit Default Indices report said.

The first mortgage default rate decreased two basis points to 1% from the previous month, and is significantly down from 1.23% a year ago.

On the other hand, the second mortgage default rate increased by two basis points to 0.66%, and is slightly up from 0.64% a year ago.

As a whole, the national composite rate remained flat, reporting a default rate of 1.12% in February.

Click to enlarge

Source S&P/Experian Consumer Credit Default Indices

“The combination of a strong February employment report and continued low oil prices all point to a buoyant economy with optimistic consumers,” said David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices.

The national unemployment rate dropped to 5.5% due with the number of people dropping out of the labor for rising by 354,000 in February to a record 92,898,000, which is the highest number of Americans not in the labor force in history.

“Mortgage default rates, the largest component in the national index, held steady and prevented a rise in the national numbers. A true test of consumer credit quality and the prospects for future default rates will come in the second half of 2015 by which time the Fed will most likely have begun to raise interest rates. Given current low levels of default rates and low debt service burdens, there are no concerns of a consumer credit crisis any time soon,” said Blitzer.

When the Federal Open Market Committee last met, the committee chose to reaffirm its view that the current 0% to .25% target range for the federal funds rate remains appropriate.

“Labor market conditions have improved further, with strong job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; recent declines in energy prices have boosted household purchasing power,” the recent minutes said.

Only two of the five major cities reported lower default rates in February. Miami reported a default rate of 1.17%, a decrease of 18 basis points, its largest decrease since September 2014. Los Angeles reported a decrease for a second consecutive month at 0.83%, down one basis point.

Click to enlarge

Source S&P/Experian Consumer Credit Default Indices