Dorothee Enskog, a journalist for the Swiss bank Credit Suisse, recently published an article on the latest findings from a study conducted at the financial firm’s internal research institute. Credit Suisse is known to operate a successful research firm, not just to sell publications, but also to study how to make more money in smarter ways.

Enskog, who reviewed the “Gender 3000” study, in which the researchers mapped the board structures and senior management of more than 3,000 companies worldwide, wrote the following conclusion: “Greater gender diversity in companies’ management improves their financial performance.”

“Enhanced female participation in management positions should not be seen as “nice-to-have” or a necessary box-ticking exercise imposed to satisfy quotas,” Enskog continued. “More women in senior management positions improves companies’ financial performance and makes a difference for investors in terms of equity market returns.”

But, striking a balance is tricky. In 2006, Norway imposed a law requiring that females occupy at least 40% of listed companies’ board seats. The quota was not well received.

“It seems that the market believed the companies were constrained in their ability to appoint the most qualified candidates to their boards,” said Stefano Natella, head of global equity research at the Credit Suisse investment banking division.

“Our concern is that governments, rather than taking board initiatives as a first step, will fail to push through additional progress, resting on the progress made,” Natella said. “Also, male-led management teams who hit their quota may then believe that all gender issues are solved and ignore the substantially larger problems they have in gaps in female representation throughout their management structure.”

The report suggests that governments should instead require board-level training for potential female directors, Enskog concluded in her write up, while regulators should demand that all publicly traded companies disclose gender data and policies in their financial reporting.

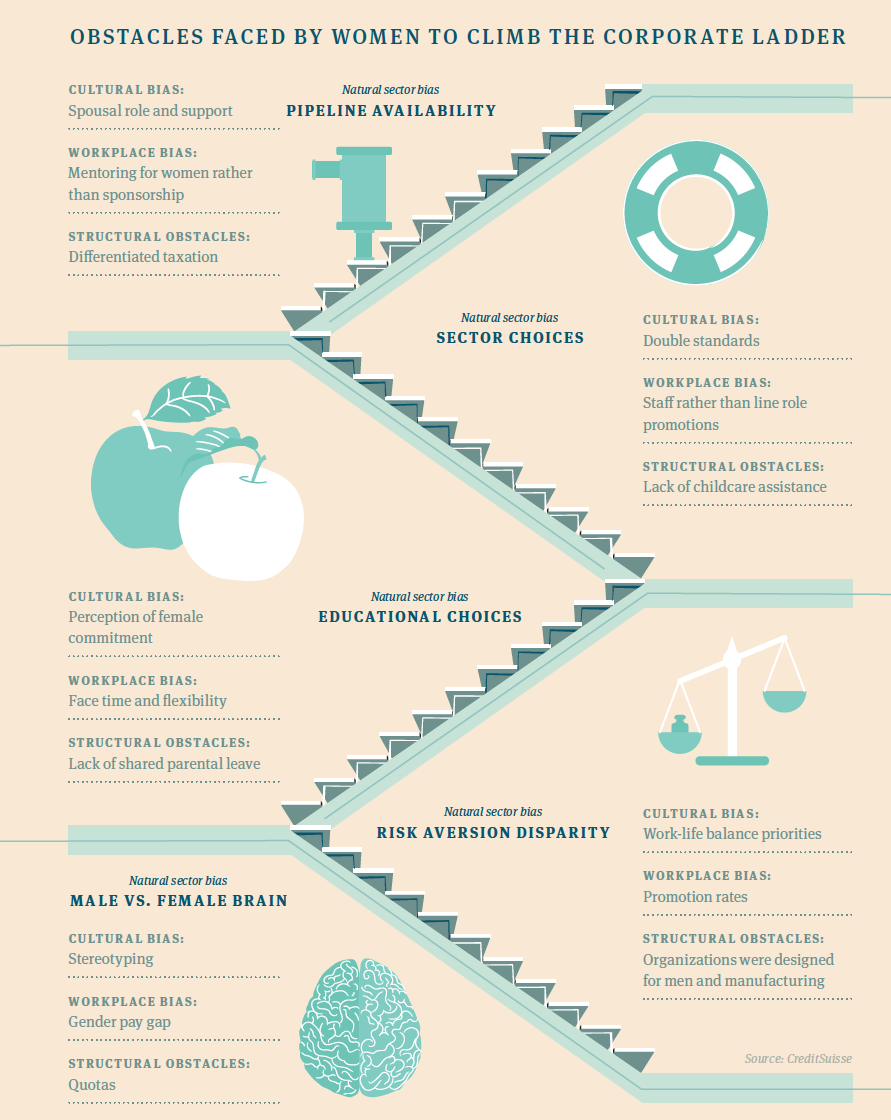

But the Credit Suisse study only touches on some of the nuances to the issue. Earning the acceptance of male peers is only one of the many obstacles women face in the workplace. Globally, women outnumber men in universities and that disparity is growing, yet the average number of women in management positions remains flat.

In short, there are more women than ever entering the workforce. So, why aren’t more making it to the top?

CASE IN POINT

Cari McCue, chief operating officer at Guardian Mortgage, had to find her voice.

Not everyone wanted her to find it, at least not immediately. Before her first meeting as a new Texas Mortgage Bankers Association board member earlier this year, she recalls how she was told to keep quiet because she was new.

“To survive as a female today in this field you have to be strong and stand up and you have to be able to put your voice out there,” she said. It’s something she’s learned to do over time during her 17 years in the business.

“To survive as a female today in this field you have to be strong and stand up and you have to be able to put your voice out there,” she said. It’s something she’s learned to do over time during her 17 years in the business.

McCue had her mother, Marcia “Marcie” Phillips, to mentor her along the way. Phillips, CEO and president of Guardian, has been in the mortgage business since the mid-1970s and CEO of Guardian, based in a Dallas suburb, since 1988.

Phillips credits one of Guardian’s co-founders, Jack Sweet, for catapulting her into the CEO suite at a time when women in mortgage finance were exceedingly rare.

“Jack Sweet had the utmost respect for strong women,” she said. “I once asked him, ‘Would you ever see a woman being president of this company?’ I guess he believed in me.”

Women have inspired, influenced and impacted many facets of housing finance, but they remain underrepresented in the industry, a realization that has captured more attention recently within industry ranks. It has resulted in new efforts to address the gender imbalance in housing finance.

There isn’t a simple statistic that shows how many women are in the industry, but some of the available statistics are stark. Of the nearly 100 bank holding companies that have $10 billion or more in assets, for example, only three are headed by females — down from five in 2011, according to American Banker.

Catalyst, a nonprofit that seeks to expand opportunities for women and business, reports that last year only 17.6% of Fortune 500 companies in the financial and insurance fields had female CEOs, and only 11.4% had female CFOs.

Faith Schwartz of CoreLogic has been in the mortgage business for more than 30 years and can relate to the stats. “I have, and continue today, to be one of the few women in the room in various circles,” she said. “I never let it feel like a big deal, but I do find myself in meetings wondering, ‘Where are all the women?’”

At businesses with 100 or more employees that are classified as “Investment Banking and Securities Dealing” just 15.6% of executive and senior-level employees were women, according to the U.S. Equal Employment Opportunity Commission. The EEOC statistics show 29% of executive/senior level positions at commercial banks are held by women.

CFPB AND MBA TAKE ACTION

The high-profile and controversial Consumer Financial Protection Bureau, formed in the wake of the financial crisis, has trumpeted its efforts to be diverse and inclusive with the appointment of women to its leadership ranks.

The Mortgage Bankers Association, arguably the most influential trade group in the space, has also taken on new initiatives to promote women into leadership roles.

The agency formed the Office of Minority and Women Inclusion to diversify the bureau’s workforce, to increase the agency’s use of women-owned and minority-owned contractors and to help develop standards that will assess the diversity at the financial institutions it regulates.Headed by Richard Cordray, the CFPB has several wellknown women among its highest executive ranks, with 47% of its leadership positions held by minorities or women.

Over the course of its short history, the CFPB has developed outreach efforts to universities, trade associations, and women- focused organizations to support recruiting efforts and is implementing a leadership training program focused on developing a pipeline of qualified women leaders.

Over at the Mortgage Bankers Association, women in leadership at the association and within the industry as a whole has been a major emphasis over the past year.

One year ago, the MBA created the Diversity and Inclusion Committee to help the industry gain a competitive advantage by increasing diversity in leadership, workforce and suppliers. Debra Still, president and CEO of Pulte Mortgage and past MBA chairman, was a co-founder and chaired the committee in its initial year.

The committee is figuring out how to get underrepresented components of the industry — including women — more involved. It identified 16 initiatives for its first year, she said.

They included hosting a summit to examine why diversity is good for business; how to recruit and retain diverse talent; and how Dodd-Frank’s Section 342, which will establish standards for assessing the diversity policies and practices of entities regulated by six federal agencies, will affect the industry.

Other efforts by the committee include a new mentoring program at Virginia State University that it hopes to expand to other college campuses and the establishment of an MBA scholarship to attract more women and minorities into the MBA’s Future Leaders Program, a one-year program geared toward middle and senior-level executives who show leadership potential.

The Mortgage Bankers Association, arguably the most influential trade group in the space, has also taken on new initiatives to promote women into leadership roles.

MBA is committed to having a diverse board of directors and diverse committees, said Still, only the second woman to be MBA chairman in the trade group’s 101-year history. (Regina Lowrie was the first woman MBA chairman in 2005.)

“I think my role as chairman of the MBA was very encouraging to a lot of women in our industry,” she said. “Every time I spoke, I had so many women coming up to me and saying, ‘This is so inspirational. How can I get involved?’ Just having some folks in leadership roles encourages others to say, ‘I’m going to join a committee.’ We have so many committees at the MBA. Start by getting on a committee. Hopefully my chairmanship planted a lot of seeds in that direction.”

In her role as CEO and president of Pulte Mortgage, Still said she mentors women to help them reach executive leadership positions.

“It’s really about how to give yourself permission to lead and how to engage in a way that is collaborative and inspirational. For me it is about serving. What can I do to add value?” she said.

SECURITIZATION ROLE MODELS

Click to read infographic. |

Of the many possible housing finance careers, securitization remains — perhaps —the most male-dominated. One reason might be because women in this field must be very comfortable with math — a subject area that boys have been steered toward since elementary age, something long ingrained in U.S. culture.

The nation’s educational system has recently placed a greater emphasis on steering girls into STEM careers — science, technology, engineering and mathematics — but no one has noted any significant gains in women entering securitization.

Andrea Bryan, a managing director at NewOak, has been active for a number of years in securitization, having spent much of her career in domestic and international CMBS securitization at Standard & Poor’s, where both men and women mentored her career.

“I loved the innovation of securitization,” she said. “While finance, in general, opens a lot of markets and creates a lot of opportunities to build wealth, I found that securitization, because it is a financial innovation tool, has the ability to really add value to finance.”

Women who excel at math can excel in the securitization field, Bryan said. The field also tends to attract attorneys because of their comfort level with reading documents, she added.

“My advice for women wanting to do anything is learn the craft, enjoy what you do. Be decisive.” It’s advice that works for any career, she said.

Pam Patenaude, director of housing policy at the Bipartisan Policy Center, said she doesn’t see the lack of women in CEO roles in housing finance as all that different from other industries. Patenaude has been in a wide range of housing roles over a 30-plus year career, including as an assistant housing secretary in President George W. Bush’s administration.

“I never felt at a disadvantage, ever, in my career, being a woman,” she said. “The BPC is an excellent example of women in power. The senior vice president, the No. 2 person at BPC, is Julie Anderson, an outstanding leader. BPC has done a very good job of recruiting talented women.”

Anastasia Stull, a managing director at NewOak and the current president of Women in Housing & Finance Inc., said a female corporate law professor encouraged her to consider securities as a career.

“She said, ‘Securities is an area where there still aren’t enough women and I think you’d be really successful in this role,’ ” Stull said. “She suggested I get a job at the Securities and Exchange Commission and sign up for the securities and financial regulation master’s of law program at Georgetown, which brought me to Washington,” Stull said.

Stull did what the professor recommended, in what turned out to be a game-changer in her career. She was introduced to Women in Housing & Finance as a young law associate and found the industry group to be a good resource for networking and access to public policy speakers and influential members of the industry.

Stull began her one-year presidency term in June.

“I feel very proud and humble to be in this role,” she said. “Women in Housing & Finance was started 35 years ago by women who wanted equal access to business and policy experts in Washington.”

LOOKING TO THE FUTURE

To be sure, it can still be a challenge for women seeking executive roles in the housing finance space.

“Women have a lot more opportunities today and should not be afraid to raise their hand, to ask for a seat at the table, or to express their views,” Stull said. “Building a strong professional network, seeking leadership roles and leveraging organizations like WHF that provide access, are effective ways to gain an advantage in an otherwise male-dominated industry.”

“Women have a lot more opportunities today and should not be afraid to raise their hand, to ask for a seat at the table, or to express their views,” Stull said. “Building a strong professional network, seeking leadership roles and leveraging organizations like WHF that provide access, are effective ways to gain an advantage in an otherwise male-dominated industry.”

CoreLogic’s Schwartz, senior vice president of government solutions for the real estate analytics firm, has been influential in her own right as former executive director of HOPE Now, a nonprofit coalition created in 2007 in the midst of the housing crisis to bring together servicers, lenders, and investors.

In that role, she created and founded HOPE LoanPort, a Web portal that provided a loan workout vehicle for the parties involved.

“I see women in good roles; they might not be the CEO but they are very influential in the C-suites,” she said. “I feel like there’s been a lot of progress for women. I started out trading securities and there were no women trading securities. I think we’ve come a long way.”

Her advice is simple: “Be curious. Work hard. Engage. And remarkably, opportunities will open up for you. There are opportunities for women to continue to do great things.”