While America has traveled a long way from the struggles caused by the Great Recession, the pain from the crisis has not fully dissipated.

This caused Freddie Mac to ask the question: What is it going to take to get the economy moving from a trajectory of low-growth to one of robust sustainable growth, with broad-based gains in income, employment and wealth?

“In our view, the necessary thrust will need to come from four ingredients: Labor, Income, Fixed investment, and Trust,” the government-sponsored enterprise said.

Labor Market Recovery:

The recovery in the housing market will continue to be gradual unless the labor market recovery can pick up the pace.

The September Census Bureau employment report said that the economy added 248,000 jobs, and the unemployment rate declined to 5.9%.

But in order for the labor force to improve further, these three things need to happen:

- First, we need labor force participation to increase for younger age groups, particularly for the critical 25 to 54 year old cohort.

- Second, we need long-term unemployment, which has been elevated throughout this recovery, to come down closer to historical norms.

- Third, we need sustained increases in wages.

Looking ahead, Freddie Mac forecasts only modest improvements in the headline unemployment rate. Next year, unemployment is predicted to average about 5.7%, since 25-54 year olds are expected to be missing from the labor market, driving participation rates up.

Income Growth:

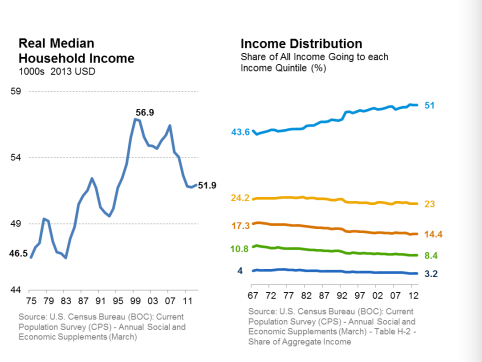

Freddie Mac explained that income growth has been tepid throughout this recovery. “In order for the economy to perform at its highest level we need to see incomes rise across the income distribution,” Freddie Mac said. “A faster GDP growth rate is the essential step to getting broad-based income growth.”

Growth has started to accelerate, with the second-quarter GDP growing at 4.6% and data suggesting that the third quarter will also be robust, growing at a 3 percent-plus annualized growth.

But for this to continue, investments, particularly residential fixed investments, to increase.

(Source Freddie Mac; click to enlarge)

Fixed Investment Normalizes:

“Fixed investment—investment in residential buildings, non-residential structure, computers, and other equipment—has been slow to recover following the Great Recession,” Freddie said.

The report explained that of the major components of fixed investment, residential spending is particularly lagging.

During the recovery from June 2009 to June 2014, residential investment—primarily the construction of new single-family homes, condominiums, and apartment buildings, and residential additions and alterations—has only constituted about 3% of GDP. This is compared to residential fixed investment averaging about 5% of GDP before the Great Recession.

Trust and confidence restored:

Lastly, in order for robust growth to kick in, households and businesses need to feel better about the overall economy.

Confidence plummeted after the Great Recession and has only gradually recovered.

Recently, confidence is growing again even with fears of a slowdown in Europe and a multitude of crises overseas.

“Given the fundamentals for U.S. growth, we remain optimistic for growth here at home even if the rest of the world slows,” Freddie Mac said. “An improving labor market, robust GDP growth, resilient U.S. consumers and a decline in the price of oil should help to bolster the economy in the short term. Longer-term, strong pent-up demand for housing and low interest rates should support continued improvements in the housing sector.”