As mortgages go, so too goes Wells Fargo. It’s an adage that certainly has run true for the past decade or so, as the banking giant has emerged as the nation’s top residential mortgage lender and second-largest residential mortgage servicer.

And, amazing as it may sound, Wells Fargo weathered the 2007-2008 financial crisis far better than nearly any other of its Too-Big-Too-Fail (technically: Systematically Important Financial Institution, or SIFI) counterparts.

The bank’s impressive run of 17 straight quarters of increasing its earnings per share came to a screeching halt, however, when the bank released its second quarter earnings report in July of this year.

The culprit? Mortgages, of course.

Second-quarter revenue slipped to $21.1 billion, down from $21.4 billion in the year ago quarter; and while that beat most Wall Street analyst expectations, the fundamentals are hard to ignore.

Wells Fargo’s mortgage business continued its fall that began in the third quarter of last year, while at least some of the impact from the decline in the mortgage business was tempered by gains in the bank’s loan and investments, as well as asset and wealth management groups (thanks mostly to a rising equity market in general).

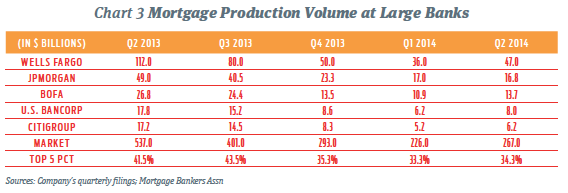

The bank made $47 billion in home loans during Q2, down from $112 billion one year ago — but up from the first quarter’s dismal $36 billion booked. Mortgage revenue dropped 39% to $1.7 billion.

The question now is simple: for a mortgage-dependent bank, is now the time for investors to put their trust in Wells Fargo, or is it better to sit on the sidelines?

THE BEAR CASE

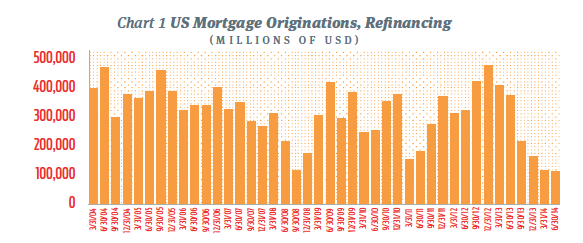

When overall U.S. mortgage volumes have been falling for 15 months, it’s only natural that the largest U.S. mortgage lender is going to face some tough headwinds.

The Mortgage Bankers Association says that industry production of residential mortgages is likely to hit $1.1 trillion in 2014, a far cry from the industry’s years of $3+ trillion in production. Some analysts, most notably those at FBR Capital, are actually forecasting a sub-$1 trillion year for U.S. mortgage markets.

This is a major issue for a mortgage-dependent bank like Wells Fargo, where roughly one fourth of the bank’s revenue is tied to its mortgage business.

First, refinancing volume is down and isn’t likely to come back soon. The short analysis here is simple: mortgage rates remain low in the low 4% range, where they’ve been since June of last year; but that’s well above the low- to mid-3% range mortgages sat at for nearly a year prior.

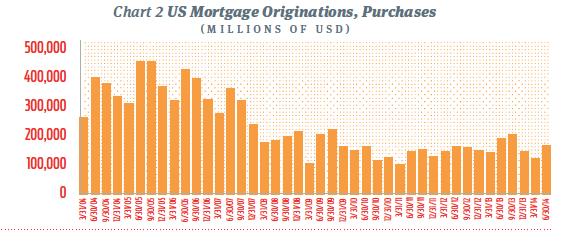

Second, the dearth of refinancing activity means that mortgage lenders like Wells Fargo are pushed to focus on purchase money mortgages — which are tied heavily to the overall strength of the U.S. economy in general, and job growth in particular.

And looking at jobs, things are improving, but slowly. The U.S. unemployment at time of press still sat north of 6% — and actually has been growing as of late as more U.S. workers reenter the workforce. The government only counts people actually searching for jobs as “unemployed.”

“The purchase market is softer than we thought it would be,” Wells Fargo CFO John Shrewsberry said in a conference call with investors and analysts discussing the company’s second-quarter results. (You think?)

But beyond the dynamics of the mortgage market itself, there remain the external forces of regulation affecting how commercial banks like Wells Fargo approach mortgages to begin with.

New industry regulations set forth from the Consumer Financial Protection Bureau discourage lending by banks — which some pundits see as a contributing factor to the drop in loan originations, perhaps even more so than consumer demand for a mortgage.

Additionally, Basel III capital rules are a strong deterrent for commercial banks relative to any and all non-prime risk exposures — and that includes residential mortgages, of course.

It’s why large commercial banks like Wells Fargo aren’t heavily engaged in non-QM lending, and may never be — despite the fact that lending outside of the narrow Qualified Mortgage standards may be the only way a mortgage lender can find loan growth in the years to come.

You don’t have to believe me that banks want out of the mortgage business. You only have to be willing to look at the data. Chart 3 provides the volume of mortgages reported by the nation’s five largest banks over the last ten quarters.

Two things should be immediately clear from Chart 3. First, that Wells Fargo’s dominant share in the mortgage market is waning steadily — and recent decisions to exit some of its home equity lending aren’t likely to change that trend soon.

Second, it should be clear that the Big 5’s percentage of the overall mortgage market is declining as well.

The bearish reality is this: Wells Fargo is largely dependent on mortgages, but mortgages are a tough business to come by right now — and the bank’s regulatory environment isn’t conducive to further growth in that line of business in the future, either.

THE BULL CASE

Ah, the bears out there. Look hard enough, and you can find evidence of anything.

The reality is this: Wells Fargo is a mortgage machine, and this is a great thing. In Chart 3, look a little more closely. Know what you’ll see?

You should see that industry originations actually INCREASED during the second quarter, to $267 billion, according to estimates from the Mortgage Bankers Association.

The first quarter of 2014 was horrible by any measure, but it wasn’t just horrible for mortgages — the whole economy took a step back thanks to an unusually harsh winter. It now appears that the drop we saw in the first quarter might have been temporary, and a look at Wells Fargo’s results should give even further reason to think this is the case.

Here’s why: while the industry saw mortgage volumes rebound by 18.1% during the second quarter, Wells Fargo saw its mortgage business spike by nearly 31% in the same timeframe.

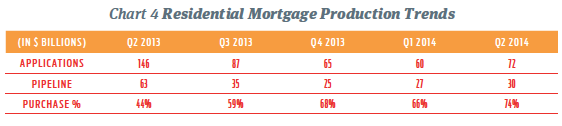

It gets better. A look at the bank’s residential mortgage productions trends, in Chart 4, below, shows even more.

Bottom line: The bank’s loan pipeline continues to grow — and Wells Fargo is making moves to incent its best loan officers that can drive purchase money business.

Bloomberg reported in early August that Wells Fargo had adjusted its compensation plan for loan officers, increasing the pay scale for top producers able to bring in purchase money business.

Does that sound like a bank that wants to get out of mortgages? The numbers and actions at Wells Fargo simply don’t match up with that sort of nonsense.

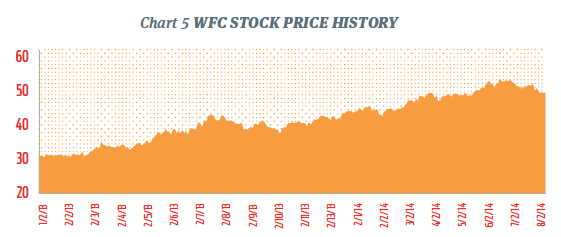

And investors — you know, those people who vote with their wallets, not an analyst’s report? — are voting for Wells Fargo, too. The company’s stock is up over 80% since the beginning of 2012.

Mortgage industry woes aside, no bank has performed better in the one metric that matters most: profit margin.

Wells Fargo was the most profitable U.S. bank last year, and the current trailing 12-month profit margin of 46.2% bests every other TBTF bank by a huge margin (JPMorgan comes in second at 28.4%, for example).

Not too bad for a bank operating in a sluggish economy and managing through the Federal Reserve’s ZIRP (zero interest rate policy). Not too bad at all.

And the amazing thing is this: the economy looks to be gaining momentum — finally! — and the mortgage business appears to be bouncing up somewhat from a first quarter trough.

That could spell future gains at Wells Fargo, and for investors wise enough to take advantage of some current market uncertainty.

Editor’s note: Bull vs. Bear is a non-positional column that presents both “bull” and “bear” cases surrounding a publicly-traded stock impacting the U.S. housing economy. Analysis focuses primarily on macro-economic factors impacting the company’s outlook and the column is designed to allow investors to choose for themselves which case they find most compelling. HousingWire does not recommend specific investments, nor should any comments in this column be construed as investment advice.