Kroll Bond Rating Agency has issued its pre-sale report for a $250 million jumbo residential mortgage-backed securitization from WinWater Home Mortgage. The offering, WIN 2014-1, is WinWater’s first securitization offering.

The company, which refers to itself as “a residential mortgage conduit aggregator focused on opportunities in the non-agency jumbo sector,” was formed by “certain principals of Premium Point Investments.”

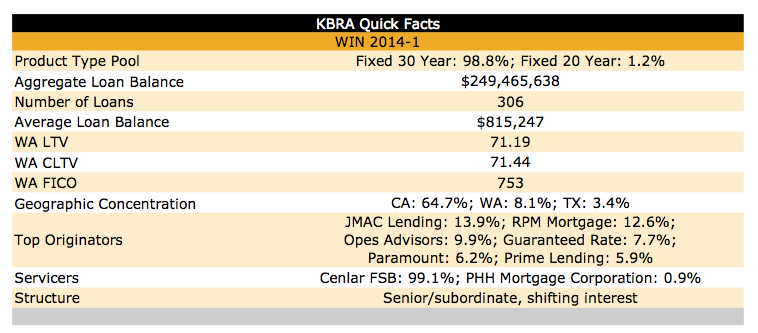

The securitization’s aggregate loan balance is $249,465,638 and it consists of a pool of 306 loans. The average loan balance is $815,247 with an average FICO score of 753 and an average loan-to-value ratio of 71.19%.

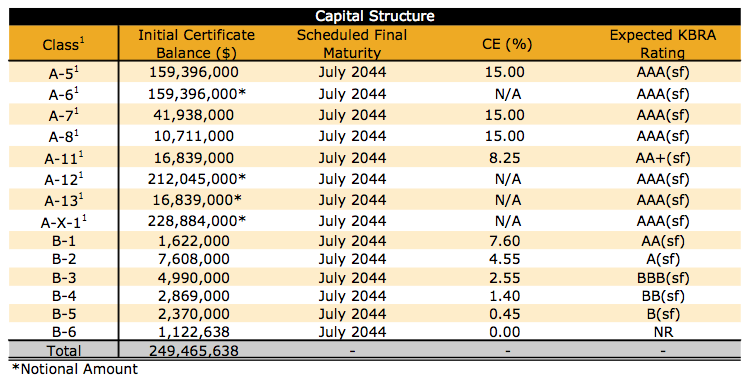

Click the thumbnail below to see Kroll's anticpated ratings of the offering's tranches.

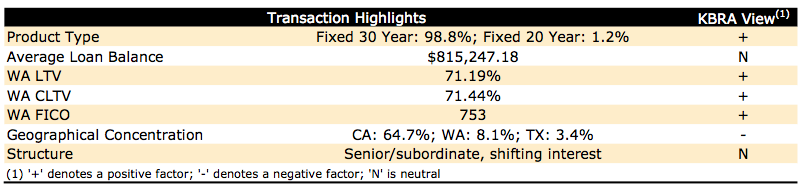

In its presale report, Kroll notes that the pool consists of “high quality, prime mortgage loans that exhibit significant borrower equity.” Kroll also notes that “the 71.2% weighted average first-lien loan-to-value ratio and the 71.4% WA first- and junior-lien combined LTV ratio provide a margin of safety against potential home price declines.”

Kroll does caution that the WA LTV and CLTV rations for this transaction are among the highest for any of the post-crisis, prime jumbo RMS transactions that the agency has rated.

Click the thumbnail below to see a breakdown of the specifics of the offering.

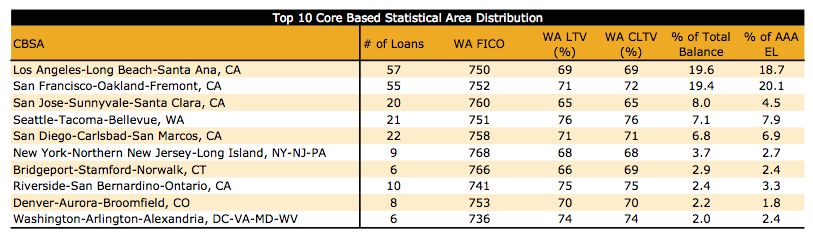

The vast majority (64.7%) of the loans are concentrated in California. The top three states make up 76.2% of the pool. Washington ranks second, at 8.1%, and Texas is third with 3.4%.

Four of the top five core based statistical areas in the securitization are in California. Los Angeles-Long Beach-Santa Ana represents 19.6% of the pool, followed closely by San Francisco-Oakland-Fremont at 19.4% of the total. The rest of the top five are: San Jose-Sunnyvale-Santa Clara representing 8% of the pool, Seattle-Tacoma-Bellevue, Washington representing 7.1% and San Diego-Carlsbad-San Marcos, California representing 6.8%.

Click the thumbnail below to see a breakdown of the top ten CBSAs.

Kroll notes that the concentration of loans in California is a concern of the deal, although given that the securitization is built from jumbo loans, “non-conforming prime mortgages are most frequently originated in those regions of the country where home prices are highest,” Kroll’s report said.

In its presale report, Kroll said that it adjusted its expected losses in the AAA tranche of the deal upward by 26.4% because of the geographic concentration.

Kroll also cautioned that pools of similar makeup often have single loans that represent 1% of the entire pool because of the size of the loan. In the WinWater offering, there are two loans that have current balances exceeding $2 million. The largest loan balance is $2.45 million, which represents approximately 0.98% of the mortgage pool. The second largest loan is $2.13 million, or 0.85% of the pool.

WinWater’s lack of experience in the market — the company was founded in 2013 and this is its first prime jumbo RMBS offering — is another potential concern, Kroll said.

But an independent third-party review of the loan files found that there were no material exceptions to underwriting guidelines or generally adequate mitigating factors for the exceptions found in the vast majority of the loans.

Click the thumbnail below to see a breakdown of Kroll's views on the makeup of the offering.

The top six loan originators of the deal are: JMAC Lending: 13.9%; RPM Mortgage: 12.6%; Opes Advisors: 9.9%; Guaranteed Rate: 7.7%; Paramount: 6.2%; Prime Lending: 5.9%.

Cenlar FSB services nearly all of the loans. PHH Mortgage Corp. services 0.9% of the loans and Cenlar services the remaining 99.1%. The master servicer and custodian is Wells Fargo.

When the offering was initially announced, Reuters reported that Standard & Poor’s and DBRS were expected to rate the securitization as well.