Mortgage insurance has always been an interesting sector for investors — and at times, a maddening one to understand. Yet, at the core, mortgage and related insurers are driven by a simple dynamic: how much revenue they can generate off of policy underwriting and premiums, and the loss experience they face against those same policies.

For Radian Group Inc. (RDN), 2013 was somewhat of a watershed year — at least at the end of the year. For the full year ending Dec. 31, 2013, the company posted a net loss of $196.9 million, significantly better than the whopping $451.4 million loss the company absorbed one year earlier. Even better, the company’s fourth quarter saw Radian return to the black for the first time in two years, posting a $36.4 million profit.

For a company that in early 2012 some thought might be on the verge of bankruptcy, that’s a pretty remarkable comeback.

It’s always a little tricky analyzing Radian’s earnings, however, because much of the company’s earnings can change simply due to reported changes in the fair market value for derivatives. For example, in the fourth quarter, the company’s $36.4 million profit included $30.6 million of net gains in fair value changes of derivatives.

That’s why, in many cases, the traditional metrics investors use won’t apply as easily to insurers like Radian (although the company does an admirable job of putting together adjusted figures to allow investors easier analysis).

But beyond the traditional investment metrics, macro-economic factors and analysis of basic business trends are equally important to understand as an investor.

And that’s what we’ll focus on here in taking a quick run through Radian’s business in an effort to decide if right now is the right time to invest long in Radian shares.

THE BULL CASE

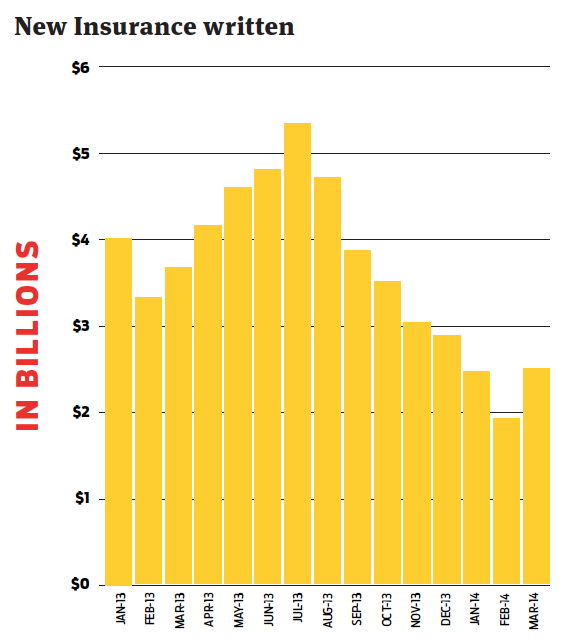

Radian’s earnings are largely driven by two factors: new insurance written and credit trends. When it comes to new policies, it looks like the tide turned for the company during March after a tough early start to 2014 for the mortgage business in general.

New insurance written (NIW) increased in March to $2.47 billion, up from $1.90 billion written one month earlier. The March increase was the first monthly increase in NIW at Radian since July 2013, signaling that a seasonal increase in home purchases generally associated with the spring seems likely to drive further increases in NIW during the months ahead.

New insurance written (NIW) increased in March to $2.47 billion, up from $1.90 billion written one month earlier. The March increase was the first monthly increase in NIW at Radian since July 2013, signaling that a seasonal increase in home purchases generally associated with the spring seems likely to drive further increases in NIW during the months ahead.

Beyond NIW, credit trends are also continuing to improve as Radian backs away from its financial guaranty business and its book of mortgage insurance business continues to center on much higher quality recent vintages.

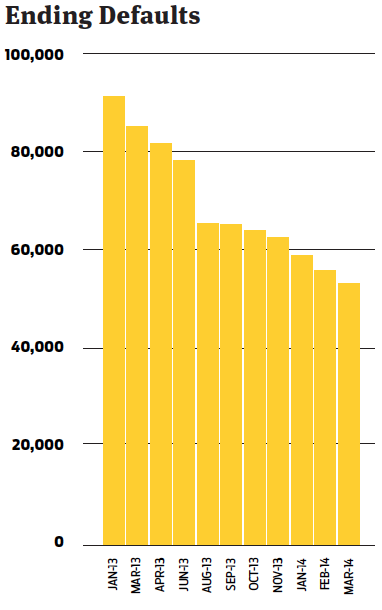

The bottom line? Defaults are down, and new delinquencies are down as well. At the end of March, Radian reported 53,119 defaults on loans it insured; that’s down dramatically from the 85,109 defaults the insurer had on the books one year earlier. New delinquencies continue to trend downward as well, dropping to just 3,607 in March 2014 — a 13.5% drop versus one year earlier, reflecting an improving housing market in most of the U.S.

The company’s more seasoned (and higher default) mortgages continue to run off, too, with new business written after 2008 representing 71% of primary risk in force by the end of 2013.

So new insurance written at Radian is on the monthly mend despite a tough mortgage market overall; and the company’s credit risk continues to improve as each month goes by. As the FHA continues to recede, the opportunity exists for even more growth ahead, too.

Even better, a dramatically slowing refinance market might actually prove to be a benefit to insurers like Radian — especially as their books of business shift to focus on lower credit risk, high-performing loans.

Persistency should improve from current levels as slowing refinance activity means policies remain on the insurer’s books longer. (Persistency refers to how long an insurance policy is on an insurer’s books, generating premiums. When borrowers refinance and pay off their old loan, it eliminates the insurance policy, too.)

Much like mortgage servicing rights going up in value at banks and servicers as borrowers stay in their loans longer — thereby generating more cash flow — the longer an MI policy is in force, the more income it generates for the insurer.

And Radian appears set to benefit from this trend.

THE BEAR CASE

Let’s not forget that Radian is a mortgage insurer, primarily. And this requires there to be new mortgages in order to drive new revenue — and in this area, Radian has faltered in the first quarter.

New insurance may have rebounded in March, but that doesn’t change the fact that NIW written is way below year-ago levels, with Q1 NIW during 2014 coming in at 37.6% below year-ago levels.

The company said during Q4 2013 earnings call that it expects $40 billion in new insurance written in 2014, but Radian’s first quarter pace in 2014 would annualize to just over $27 billion written in 2014 — far off of that pace.

The company said during Q4 2013 earnings call that it expects $40 billion in new insurance written in 2014, but Radian’s first quarter pace in 2014 would annualize to just over $27 billion written in 2014 — far off of that pace.

Lest you think this is a simple seasonal effect, you need to understand that in comparison, Radian’s first quarter NIW from 2013 annualized to just over $43.6 billion.

This should underscore a simple truth: it’s awful hard to drive revenue in the long-term as an insurer if you’re not writing new policies at the rate you once did.

The company’s improvement in credit trends will likely continue and allow it to perform in the near-term, but over time? A lack of new business being observed now will hurt performance in 2015 and beyond, limiting growth prospects for the share price.

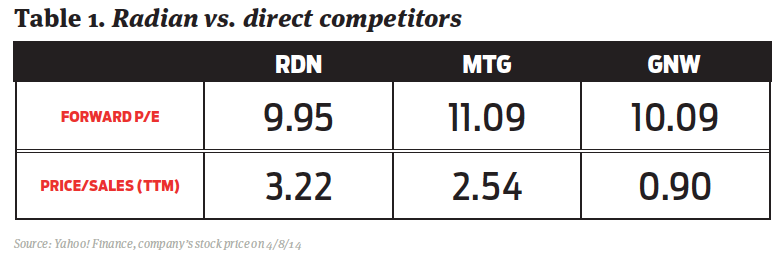

And that should be of concern to an investor looking at the basics: Radian’s stock, at the time this column was written, was already at roughly 10x on forward price/earnings, in line with similar forward valuations for competitors MGIC (MTG) and Genworth (GNW).

Further, investors have already placed a premium on the company’s prior revenue with a price/sales ratio that is higher than any comparable direct competitor.

To complicate matters in the market for so-called legacy insurers, the mortgage insurance market has heated up in 2014 with the launch of at least three competing insurers: Arch MI, National MI and Essent.

All of these new competitors will take at least some share of the market for mortgage insurance going forward, making it more difficult for Radian to capture as much MI business share as it did in 2013 — doubly so given the expected significant drop in overall mortgage originations, too.

Putting all of this together, it means that investors have already priced in Radian’s return from the brink; the MI space is getting more crowded just as overall mortgage volume is set to decrease; and first quarter underwriting results suggest future revenue weakness to come.

Investors would be wise to sit on the sidelines and let this sort itself out, until there is more clarity about how current market conditions will affect Radian and other mortgage insurers now competing for business in this suddenly crowded segment.

Editor's note: Each month, HW Magazine publishes a non-bylined column called The Angle that looks at a publicly-held company in the housing economy and presents a bull and bear investment case. HousingWire does not take a position on the stock being analyzed, and leaves it up to the reader to independently determine which case is most persuasive for their own investment objectives.