The government-sponsored enterprise Freddie Mac enjoyed its fifth-straight year of profits and, this morning, announced the return of nearly $106 billion to taxpayers.

For the full year, Freddie earned $14.4 billion of net interest income, down 4% from 2015.

The GSE's expected revenue declines in the investments portfolio were largely offset by higher single-family guarantee fee income.

[For the year in g-fee news, click here.]

That g-fee income helped drive nearly $3.9 billion ($4.8 in net income) in fourth-quarter income, compared to $2.3 billion in the third quarter.

This also includes $2.3 billion of market-related gains, primarily driven by a significant increase in longer-term interest rates during the quarter.

“Our single-family business continues to grow, and we were once again the nation’s leading multifamily lender,” CEO Donald Layton said. “We have the best overall credit quality in nearly a decade.”

“Additionally, we are the leading innovator in credit risk transfer and the efficient reduction of legacy assets – enabling us to systematically reduce taxpayer exposure to mortgage risks,” he added. “Alongside these improvements, we are more effectively delivering on our community mission each year – with new products and programs which increase access to credit for more homebuyers and which fund affordable rental housing across the nation.”

According to the earnings statement, Freddie’s post-2008 portfolio, which excludes HARP and other relief refinance loans, grew to 73% of the credit guarantee portfolio, from 66% in 2015.

Mortgage purchase volume is up 12% from 2015, at $393 billion, driven by higher refinance volume in the continued low-interest-rate environment.

Serious delinquency rate is also the lowest since June 2008.

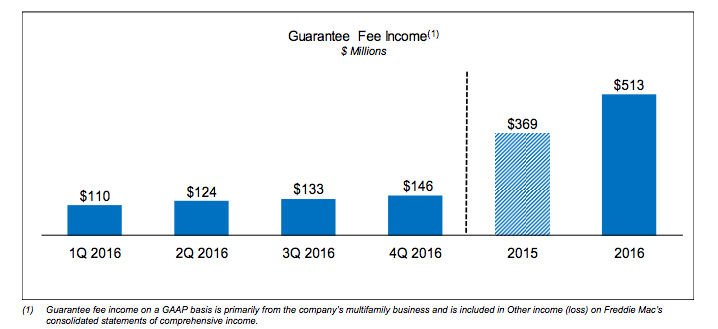

Guarantee fee income, primarily from the company’s multifamily business, was $513 million for the full-year 2016 and $146 million for the fourth quarter of 2016, an increase of $144 million and $13 million from the full year 2015 and the third quarter of 2016, respectively.