Now I don’t have any fancy statistics to back me up, but I am willing to bet that the long-term results of saving and buying a new home will outlast your proclamation that THIS is the year you're going to get fit.

Don’t get me wrong. I fully support your decision to get in shape. In fact, if you’re feeling super gung ho this New Year’s, do both.

But for this discussion, we are only going to focus on the issue of homeownership.

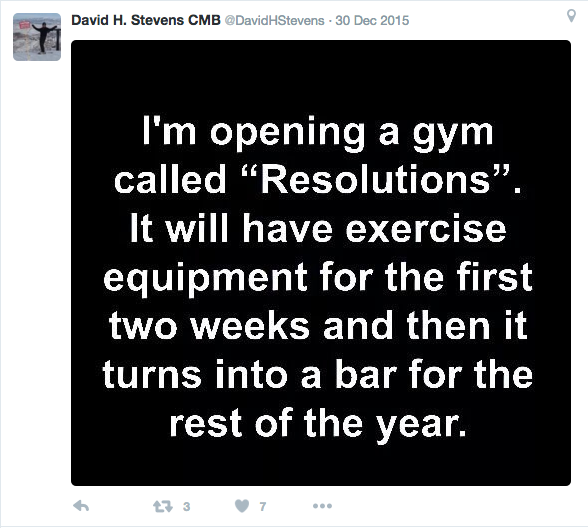

As for your weight loss initiatives, this is all I (and David Stevens, the CEO and president of the Mortgage Bankers Association) got for you:

Now, here’s the housing situation you’re walking into in 2016.

Housing is projected to get less affordable for potential borrowers in 2016 due to higher interest rates and rising home prices.

And if you overcome those obstacles, you’re going to need to be very lucky to lock in the exact house you want because inventory is so tight.

Not everything is working against you though. The job market is doing well and mortgage interest rates are still at historical lows.

If all this sounds good to you or you simply have other factors that are spurring you to a buy a home, it’s time to start improving your financial situations and save for a down payment.

According to Trulia, it is typical for young households (ages 25-34) to only be able afford up to a 10% down payment.

An article in U.S. News lists 5 bad New Year’s resolutions to improve your finances and replaces them with goals that are specific and measurable.

For example, debt-to-income ratio is a huge deciding factor on credit scores and it’s one of the first things that lenders look at when putting your mortgage together. Lenders want to know how much debt borrowers have already accumulated compared against their income. The more debt the borrower has, the less of a loan they will be able to get.

Resolution: Pay off $150 of debt each month, or $1,800 over the year.

A vague resolution to pay off debt won’t get you anywhere. Instead, resolve to pay off a specific amount of debt per month, or a specific amount of debt over the course of the year. Just be sure that your goal includes a dollar amount and an end date.

Here’s another example from the article.

Resolution: Rather than spend less money, cut $50 per month off the grocery bill

The first resolution is admirable, but too vague to be meaningful. Spending less money is great, but how much less should you be spending? Where should you cut spending? The second resolution answers those questions and gives you a monthly measuring stick to see if you’re meeting your goal.

Try and implement these resolutions at the start of this year to better prepare yourself to own a home by the end of the year. Check out the article for the full list of New Year's resolutions to better your financial situation in 2016.