Of the three required scenarios under Dodd-Frank, both government-sponsored enterprises will need assistance from the Treasury under the severely adverse scenario.

Since the creation of Dodd-Frank, the GSEs are now required to conduct annual stress tests to determine whether the companies have the capital necessary to absorb losses as a result of adverse economic conditions.

The stress tests come with three metrics: a base, adverse and severely adverse scenario.

“Based on the severely adverse scenario, in which a sudden shock creates a deep recession, Fannie Mae would require incremental Treasury draws of $34.4 billion,” Kelli Parsons, senior vice president and chief communications officer for Fannie Mae, said.

However, Parsons explained, “If the company were required to make a one-time accounting adjustment relating to its deferred tax assets, that number would be $97.2 billion, depending on the accounting treatment of deferred tax assets.”

From there, Fannie Mae’s remaining funding commitment under the Senior Preferred Stock Purchase Agreements would be $83.1 billion without re-establishing a valuation allowance against deferred tax assets.

But if Fannie Mae re-established a valuation allowance against deferred tax assets, the remaining funding commitment would be $20.4 billion.

These results of the severely adverse scenario are not surprising given the company’s limited capital. Under the terms of the senior preferred stock purchase agreement, Fannie Mae is not permitted to retain capital to withstand a sudden, unexpected economic shock of the magnitude required by the stress test.

Meanwhile, Freddie Mac reported much of the same.

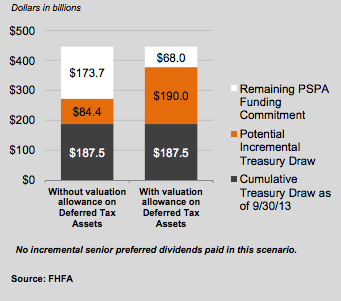

Using the severely adverse scenario, in which a sudden shock creates a deep recession, Freddie would require Treasury draws of $49.9 billion.

If Freddie was required to make a one-time accounting adjustment relating to its deferred tax assets, that number would be $92.8 billion, depending on the accounting treatment of deferred tax assets.

Freddie’s remaining funding commitment under the Senior Preferred Stock Purchase Agreements would be $90.6 billion without re-establishing a valuation allowance against deferred tax assets. However, if Freddie re-established a valuation allowance against deferred tax assets, the remaining funding commitment would be $74.7 billion.

And while the enterprises passed the first two scenarios, the industry noticed the need for Treasury help.

Financial Services Roundtable expressed concern about the stress test results since it could potentially cost the American taxpayers as much as $190 billion if the economy takes a severe downturn, according to their regulator.

“These staggering figures reinforce the urgent need to replace Fannie and Freddie with a system backed by the private market,” said FSR CEO Tim Pawlenty. “Keeping taxpayers 100% financially responsible is no longer tolerable.”

Looking ahead, even though this year, as in previous years, the enterprises conducted the Federal Housing Finance Agency’s three scenarios, in conjunction with the Dodd-Frank stress test, next year the enterprises will be required to conduct only the Dodd-Frank Act Stress Test.

(from the FHFA)

This is in contrast to the FHFA scenario results; they post a much different, brighter picture.