Industry groups and even a government watchdog on the US Department of Housing and Urban Development (HUD) appeared Thursday before a House Financial Services Subcommittee on Oversight and Investigations, calling for more resources to prop up a HUD program’s growing presence in the residential mortgage market. HUD’s written testimony acknowledged the Federal Housing Administration‘s expanding share of the single-family mortgage market, from 3% to 30% in just a few years. The FHA lending program, which insures servicers against default-related loss on FHA-guaranteed mortgages, needs at least another $37m in funds for HUD to combat mortgage fraud and predatory practices throughout the expanding program, according to the department’s statement. “HUD recognizes that the current market environment increases the potential for mortgage fraud and predatory practices on multiple fronts,” HUD officials said in the prepared testimony. “On one level, the significant expansion in the volume of FHA insured loans exposes the insurance funds to increased risk of abuses within the program… At the same time, new forms of predatory practices are on the rise.” And HUD isn’t just sitting by while fraud occurs; its current preventative initiatives span consumer outreach and education programs, increased oversight of FHA lenders, tightening of the lender approval process and expansion of its risk-based monitoring systems. So far for the fiscal year 2009 (which began in fall of 2008), as of May 31 HUD referred 543 cases of suspected fraud to the Office of the Inspector General (OIG), according to the department’s written testimony. But it isn’t enough. The inspector general for HUD, Kenneth Donohue, also appeared before the House subcommittee calling for more resources. To illustrate the explosion of FHA’s presence in the market since the development of the near-third statistic often exchanged by industry players and media outlets, Donohue said data show the FHA’s endorsements (or guarantees of mortgages) rose from 24% of the single-family market in the first quarter of 2008, to 63% of the market in Q109, including home sales and refinance. “We continue to remain concerned regarding FHA’s ability and capacity to oversee the newly generated business… . The surge in FHA loans is likely to overtax the oversight resources of the FHA, making careful and comprehensive lender monitoring difficult,” he said, according to prepared statements. Donohue also said past data show that high-volume periods at FHA leave the program vulnerable to exploitations by fraud schemes. He urged even more resources beyond the Omnibus Appropriations Bill to enhance IT systems, increase personnel to meet processing needs, increase training, oversee contractors it maintains and increase oversight of front-end issues like appraisal, lender approval and underwriting process. He expressed concern for Ginnie Mae’s MBS program, which carries the full faith and credit of the US government and which requires Ginnie to take the fall if an issuer fails to make the required pass-through payment. Ginnie’s program will eventually take on an influx of FHA reverse mortgages, which Donohue says may be fraught with potential fraud schemes. He also said the OIG is concerned for the FHA’s reserve fund, which was at about 3% of its total insured portfolio at the time of the last actuarial review in September 2008. But that was September, and a lot has happened since then. If more severe economic conditions are factored into the calculation, the reserve could dip below the 2% minimum required by law, according to Donohue. The OIG’s concern over the solvency of the reserve fund led to various investigations, including reviews of at least two FHA lenders that migrated from subprime. OIG’s concerns with the FHA process include inadequate quality controls, reliance on manua l processes, overdependence on the honesty of participants, tendency to focus on entities (mortgagee or lender) rather than individuals (owner, officer, director) and an overall need to work more closely with the mortgage industry, according to Donohue’s statements. Potential fraud threats the OIG keeps an eye on include appraisal fraud, id theft, origination fraud, rescue/foreclosure fraud, bankruptcy fraud, reverse mortgage fraud and nursing home-related fraud — like one instance in which the US Justice Department alleges Capmark Finance obtained HUD guarantees through false applications, costing the federal program nearly $25.9m when two nursing homes defaulted on their loans. The National Association of Realtors (NAR) echoed the fraud concerns in its own written statement, which acknowledged the average credit of borrowers in the FHA program has improved as underwriting tightened, posing a positive effect on the program. NAR’s concerns regarding the FHA, however, reiterate the need for more resources. FHA’s single-family program operates nationwide with a staff of 900 — about 160 positions less than needed — with 18 year-old technology, according to NAR. “As FHA’s volume increases, it is imperative that FHA have the staff resources and the risk management processes in place to protect the Insurance Fund and the American taxpayer from unacceptable losses,” NAR officials said in the prepared remarks. But beyond the ractionary infusion of more resources just when things are looking dire at the FHA program, swift action to prevent another infrastructure crisis is imperative, according to prepared remarks by the Mortgage Bankers Association (MBA) chairman David Kittle. He urged Congress to appropriate $25m each fiscal year through 2013 as authorized in HERA to put necessary staff and technology in place as it’s needed, and to increase resources at Ginnie Mae so that its MBS program is equipped to deal with unforseen defaults. “Our government frequently finds itself in the position of reacting to problems, often when they have reached a crisis level,” Kittle said. “We have a chance, starting with this hearing today, to prevent possible problems at FHA by getting the agency the resources and tools it needs to succeed in the new mortgage environment. FHA is an important agency and meeting its needs now and for the future is critical to the health of the mortgage industry and housing consumers in America.” Along with increased funding in the future to prop up FHA’s infrastructure, Kittle also urged the permanent increase of FHA’s loan limits, which expire for high-cost areas on Dec. 31, when the limit drops from $729,750 back down to $625,500. A permanent increase, he said, would allow secondary market support of “the broadest spectrum of home prices possible” even as the unstable housing market continues to stumble along toward bottom. Write to Diana Golobay. Disclosure: The author held no relevant investment positions when this story was published. Indirect holdings may exist via mutual fund investments.

Industry Calls For Resources to Support FHA Growth

Most Popular Articles

Latest Articles

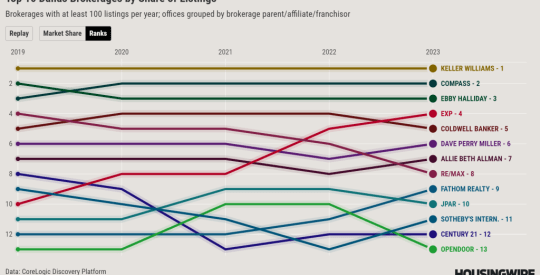

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders