Judges pushing Florida’s so-called ‘rocket docket’ ignored court rules regarding affidavits and often issued final judgments the same day a foreclosure filing was docketed, according to an American Civil Liberties Union lawsuit. In July, the 20th Judicial Circuit Court of Florida faced a backlog of 40,000 civil and foreclosure cases filed over the previous three years. But affidavits filed last week by ACLU attorneys representing homeowners, suggest Florida’s attempt to speed up the process has been a detriment to homeowners challenging their foreclosures. The ACLU filed its petition with a Florida appellate court last week in an attempt to block the court from rushing foreclosures through this “rocket docket.” In its filing, defense attorneys from across the state complained of judges’ actions. The rocket docket was used in all five counties in the southwestern Florida circuit: Lee, Collier, Charlotte, Hendry and Glades. Todd Allen, a foreclosure defense attorney practicing in both Collier and Lee counties, has represented 283 defendants since September and attends hearings in Lee County three to four times per week, according to an affidavit he filed with the ACLU lawsuit. “Because the judges assigned to foreclosure cases hear them in consolidated blocks of time and tend to spend only a few minutes on each case, the structure of the ‘mass foreclosure’ docket in Lee County allows me to observe dozens of foreclosure proceedings each time I attend a hearing in one of my own cases,” Allen said in a signed affidavit. He filed an order with the court in November to dismiss a foreclosure case from HSBC Bank on the grounds that the bank’s attorneys did not attach sworn or certified copies of all papers referred to in an affidavit as required under a court rule. Judge James Thompson of the 20th Circuit Court ruled that in his 30 years on the bench he had never understood the court rule requiring the copies and he said it did not apply to a foreclosure case, Allen said. “I find this statement particularly disturbing because the subject matter referred to in these affidavits is often quite complex – it typically includes detailed accounting and financial documents,” Allen said. Justin Cottrell, another attorney working in the area, claimed records were properly attached to affidavits roughly 10% of the time, according to his affidavit attached to the ACLU petition. “On the occasions when I have seen defense attorneys make arguments based on failure to attach records, I have repeatedly seen judges reject this argument,” Cottrell said. Little voice for the delinquent? By the end of January the court had reduced its backlog by more than 10,000 cases, claims Charles Cadrecha, another attorney practicing in these counties. In his signed affidavit, he stated that foreclosure defense attorneys often tried to dismiss cases when the plaintiff showed a deficiency, but time and again, the judge responded “that the importance of reducing the caseload meant that the case needed to keep moving forward,” Cadrecha claimed. Part of this effort includes denying a delinquent homeowner a say in court, according to the affidavits. Todd Allen said this issue is the “most frustrating.” Lee County judges, he said, have dismissed a homeowner’s right to pursue what he sees as valid discovery requests if the homeowner is not current on the mortgage. “On several occasions, Judge (Hugh) Starnes has disposed of this issue by asking whether a homeowner is current on his or her mortgage; if the answer is no, Judge Starnes will state that discovery has no bearing on the bank’s right to foreclose,” Allen alleged. “Being current on one’s mortgage is not the sole issue in a foreclosure case, nor is it dispositive.” The numbers Michael Olenick is a software engineer and CEO of Legalprise, which operates a database of judicial foreclosure docket data in Florida. The database is maintained by downloading case information and filings directly from the servers in 26 of Florida’s 67 counties. He found final judgment of foreclosure had been entered 5,290 times since January 2009 on the same day as a notice of filing or affidavit was docketed. A final judgment was entered another 1,660 times within 20 days of the filing, and 6,950 times within 20 days of “some piece of summary judgment evidence.” Olenick found moving cases onto the rocket docket began in August, during which 1,923 cases were set for the mass docket. That number peaked three months later in December when nearly 5,000 cases were set for the rocket docket in that month alone. He believes “these numbers to substantially undercount the true total” because he excluded docket entries with slight typographic or stylistic variations. Working through the backlog Florida has one of the most backlogged foreclosure systems in the country. According to RealtyTrac, it holds the eighth highest foreclosure rate with one in every 472 properties receiving a filing in February. However, it holds the highest amount of lis pendens, or suits pending, at 8,667 that month. The overload has caused banking attorneys, not just the courts, to ramp up speeds to the point where some are now alleging they cut corners. The Florida attorney general has put several firms under investigation for a range of issues, including robo-signed documents, notarization problems and improper process servicing, to forged documents. The most prominent firm suspected of the dealings is the law offices of David J. Stern, which ceased foreclosure work March 31 and was delisted from Nasdaq, as banks and the government-sponsored enterprises pulled their business. The banks have defended their foreclosure actions. In a third-quarter conference call with investors, Bank of America (BAC) CEO Brian Moynihan said past foreclosure decisions were accurate and borrowers who received an eviction were delinquent on their loan for 560 days on average. Beyond banks, others are suspect of the ACLU allegations, claiming that there could be just as much evidence of properly completed foreclosure cases. “While the ACLU relies upon a host of statistical and anecdotal evidence to support its lack of due process contentions, I expect there may be equally significant statistics and anecdotal evidence going the other way which may undercut the ACLU’s position,” said Anthony Laura, a partner at the law firm Patton Boggs. A spokesperson for the 20th Circuit Court declined to comment. Florida Bar President Mayanne Downs wrote in an email to several attorneys, defending the Lee County judges. She said claims of them acting inappropriately were unfounded. “They actually show judges working hard to do their jobs as well as they can, and to find the appropriate way to process the staggering caseloads they must manage,” Brown said in the email that was confirmed by HousingWire. “These thoughtful judges are communicating about how best to proceed, trying to understand what their colleagues are doing, sharing approaches, and obviously interested in the best possible approach to a difficult problem.” In their affidavits, however, the foreclosure defense attorneys said the legal system feels weighted against them and their clients, has discouraged many from continuing to practice and has left even more homeowners without proper representation. “As a result of these problems, I am skeptical about accepting future foreclosure cases in Lee County,” lawyer Cadrecha said. Write to Jon Prior. Follow him on Twitter @JonAPrior.

Florida foreclosure defense attorneys allege ‘rocket docket’ abuses

Most Popular Articles

Latest Articles

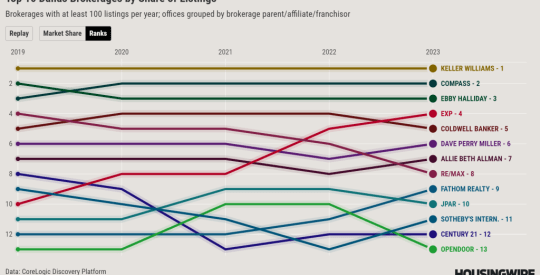

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders