The level of delinquencies on commercial real estate loans in collateralized debt obligations slid back to 14.1% in May from 14.8% the month prior, according to Fitch Ratings. Analysts said asset managers in the sector reported losses of about $73 million last month from the disposal of defaulted and credit-impaired assets. Nine new delinquencies in May were offset by 18 loan workouts, according to the ratings agency. In April, CREL CDO delinquencies rose to 14.8% from 14.1% in March. Fitch Director Stacey McGovern said the realized losses are in line with the monthly average of the past year. She said delinquency rates of the CDOs range from 0.8% to 45.2%, yet the level of loans past due “is not expected to impact” the agency’s ratings because Fitch analysis accounts for potential increases in delinquencies. Fitch rates 33 CREL CDOs and said most of the “senior classes continue to receive pay down to their most senior classes, as the CDOs either exit their reinvestment periods or have periods of over collateralization test failure.” “However, ratings on the most junior classes remain subject to volatility as future realized losses may differ from current expectations,” according to Fitch. The 33 CREL CDOs rated by Fitch include about 1,100 loans and 400 securities/assets with a total value of $19.9 billion. Write to Jason Philyaw.

Delinquencies in commercial real estate CDOs slid to 14.1% in May

Most Popular Articles

Latest Articles

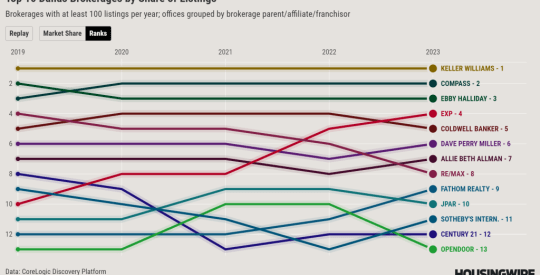

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders