Keeping up with the rest of the year, the Office of the Comptroller of the Currency’s latest quarterly report on mortgages showed that borrowers are continuing to get better at paying their mortgages.

The overall performance of first-lien mortgages continued to improve, while the number of loans in delinquency continued to decline, according to the OCC’s fourth quarter 2016 report.

The OCC collects data on first-lien residential mortgage loans serviced by seven national banks with large mortgage-servicing portfolios. The seven national banks include: Bank of America, Citibank, HSBC, JPMorgan Chase, PNC, U.S. Bank and Wells Fargo. However, data through the fourth quarter of 2015 includes CIT/OneWest.

The report falls in line with previous reports that showed the overall performance of mortgages improving from the previous year.

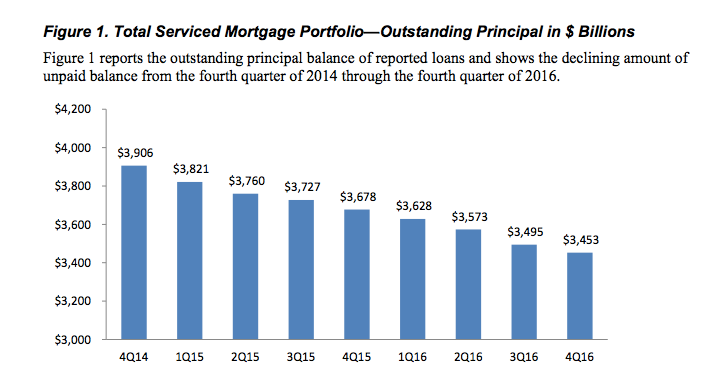

As of Dec. 31, 2016, the reporting banks serviced approximately 19.8 million first-lien mortgage loans with $3.45 trillion in unpaid principal balances, making up 35% of all residential mortgage debt outstanding in the United States.

The chart below displays the outstanding principal balance of reported loans and shows the declining amount of unpaid balance from the fourth quarter of 2014 through the fourth quarter of 2016.

Click to enlarge

(Source: OCC)

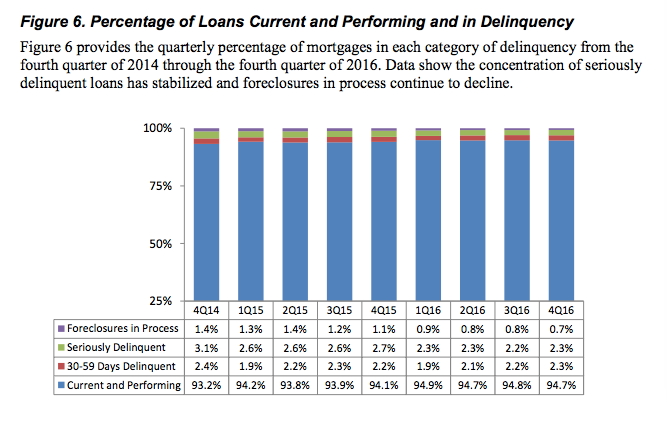

Of the loans serviced by the seven largest banks, the overall performance of mortgages improved from a year earlier. The percentage of mortgages that were current and performing at the end of the fourth quarter of 2016 increased to 94.7%, compared with 94.1% a year earlier.

The chart below provides the quarterly percentage of mortgages in each category of delinquency.

Click to enlarge

(Source: OCC)

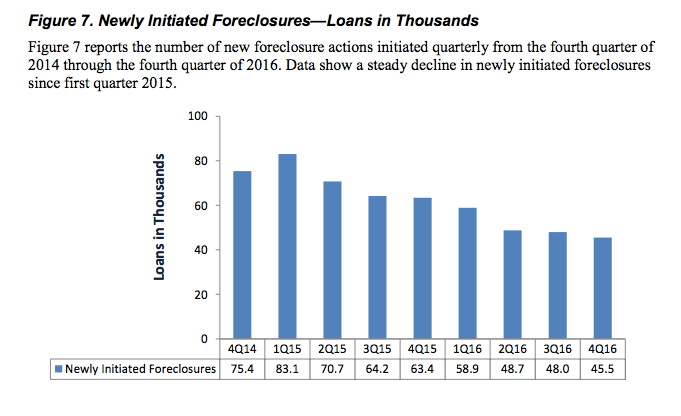

Servicers also initiated less foreclosure actions. The OCC noted that foreclosure actions progress to sale of the property only if servicers and borrowers cannot arrange a permanent loss mitigation action, modification, home sale, or alternate workout solution.

Servicers initiated 45,495 new foreclosures in the fourth quarter of 2016, falling 5.1% from the previous quarter and 28.2% from a year earlier.

Click to enlarge

(Source: OCC)

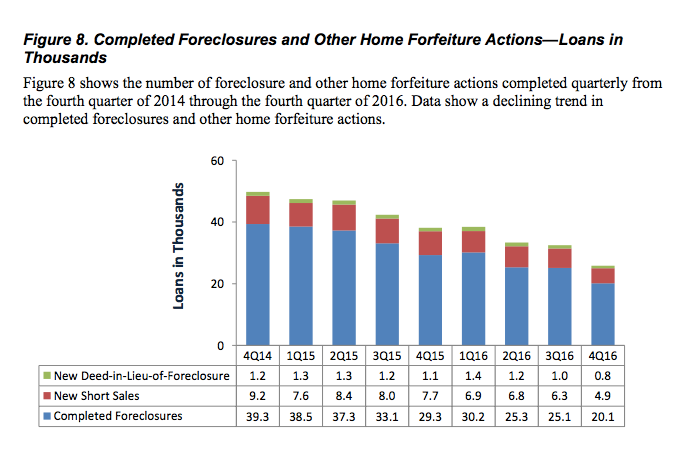

Lastly, home forfeiture actions during the quarter— completed foreclosure sales, short sales, and deed-in-lieu-of-foreclosure actions—dropped 32.3% from last year, to 25,818.

Click to enlarge

(Source: OCC)

As mentioned in previous reports, it’s important to note that the servicing share that the seven banks hold is dropping.