JPMorgan Chase officially fulfilled its $4 billion consumer relief obligation under its settlement with the federal government and five states, concerning claims that Chase, Bear Stearns and Washington Mutual packaged and sold bad residential mortgage-backed securities to investors before the financial crisis.

This is the ninth and final report from Joseph Smith, monitor of the JPMorgan Chase Residential Mortgage-Backed Securities Settlement, credited Chase with providing $4,063,880,724 of consumer relief to 168,960 borrowers.

Under the terms of the settlement, Chase was required to provide $4 billion in credited consumer relief by Dec. 31, 2017.

Chase reached this mark by March 31, 2016, according to Smith’s report.

“We are pleased to have fulfilled our requirements under the Settlement. The $20 billion in consumer relief we’ve provided to customers over the last several years is part of our ongoing efforts to help families and communities that may be struggling,” said Elizabeth Seymour, a spokesperson for JPMorgan Chase.

In the monitor’s last report back in May, Smith credited Chase with providing $3,887,777,119 of consumer relief to 165,191 borrowers. The report was through the third quarter of 2015.

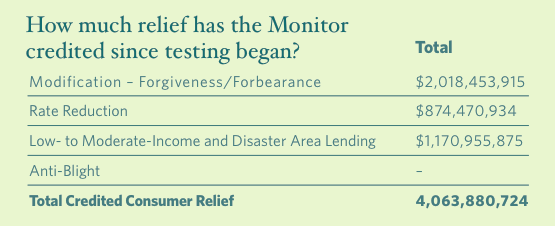

The chart below shows the type and how much relief the monitor has credited since testing began.

Click to enlarge

(Source: Joseph Smith)