Appraisal volume increased slightly the week of April 10, with the four-week average following suit and rising, according to the latest report from a la mode, an appraisal forms software company that tracks appraisal volume throughout the country and provides its findings exclusively to HousingWire.

In the latest note, a la mode said, “We discovered a programming change on March 24 that altered the way an appraisal start was identified, so we’d like to issue an apology and put out corrected numbers for the weeks of 3/20, 3/27 and 4/3.”

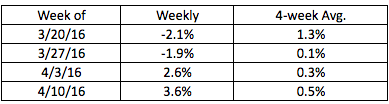

As a result, here is a chart with the update numbers.

Click chart to enlarge

(Source: a la mode)

“The index appears to be plodding along this spring, not able to overcome tight credit, low inventory and rising prices despite the glimmer of hope from falling interest rates,” said Kevin Golden, director of analytics with a la mode.

According to Freddie Mac’s latest Primary Mortgage Market Survey, mortgage interest rates continued their downward trend, falling again to the lowest level of the year and the lowest level in nearly three years.

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness is determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.