Appraisal volume shot up as buyers rushed to the market to buy homes before interest rates start to rise, a la mode, an appraisal forms software company that tracks appraisal volume throughout the country — and provides its findings exclusively to HousingWire.

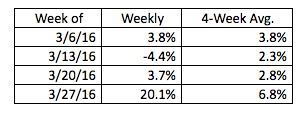

Volume surged 20.1% for the week of March 27. This is welcomed news after volume dropped off at the end of winter.

Click to enlarge

(Source: a la mode)

“The National Appraisal Volume Index rose a dramatic 20.1%, up significantly from 3.7 the prior week. The 4-week average of the NAVI rose to 6.8% from 2.8%. The boost came from comments made by the Fed Chairman, Janet Yellen, who gave an indication that the Fed was less likely to raise interest rates than previously thought,” explained Kevin Golden, director of analytics with a la mode.

Federal Reserve Chair Janet Yellen went on record at the end of March saying that the U.S. central bank should proceed "cautiously" as it looks to raise interest rates again, because inflation has not yet proven durable against the backdrop of looming global risks to the U.S economy.

According to the most recent mortgage survey from Freddie Mac, mortgage rates are low for now, but this could quickly change, pending future Fed interest rate decisions.

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness is determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.