Mortgage rates remained stagnant for the week ending March 31 amid recent comments from Federal Reserve Chair Janet Yellen, according to Freddie Mac’s latest Primary Mortgage Market survey.

Earlier this week, Yellen gave a speech to the Economic Club of New York, which was the first time she went on the record since the last FOMC meeting.

In her speech, Yellen said, the U.S. central bank should proceed "cautiously" as it looks to raise interest rates again because inflation has not yet proven durable against the backdrop of looming global risks to the U.S economy.

As a result, Sean Becketti, chief economist for Freddie Mac, said that this triggered a rally in Treasury markets and drove the 10-year yield down 13 basis points from last week’s high.

“Yellen’s comments came too late to affect this week’s mortgage rate survey, and the 30-year mortgage rate remained unchanged at 3.71%. However, if the Fed’s cautious tone persists, mortgage rates may register the impact in subsequent weeks,” he said.

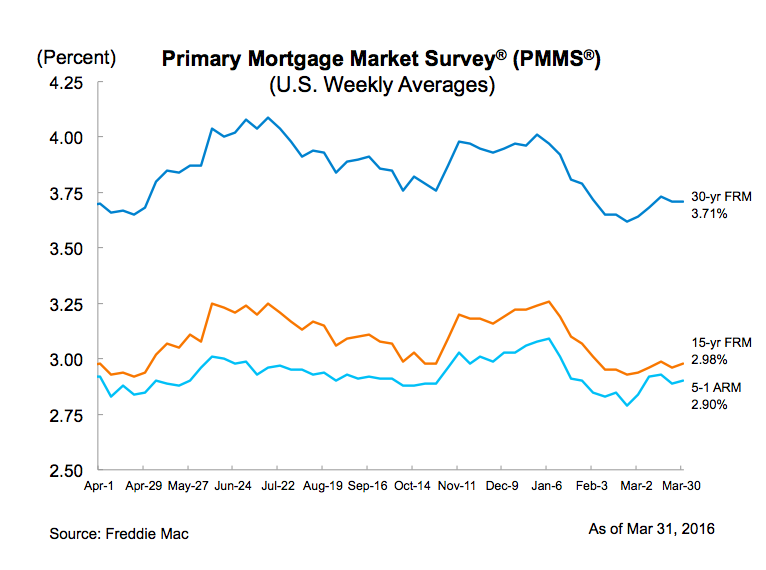

Click chart to enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage averaged 3.71% for the week ending March 31, 2016, unchanged from last week. A year ago at this time, the 30-year FRM was only slightly lower at 3.70%.

Similarly, the 15-year FRM this week averaged 2.98%, barely up from last week when it averaged 2.96%. A year ago at this time, the 15-year FRM was also at 2.98%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.90% this week, up from last week when it averaged 2.89%. A year ago, the 5-year ARM averaged 2.92%.