There is no urgency to lower mortgage insurance premiums right now, David Stevens, Mortgage Bankers Association president and CEO, said following the Federal Housing Administration’s 2015 Actuarial Report released on Monday.

The annual report to Congress revealed that the Mutual Mortgage Insurance Fund grew significantly in fiscal 2015, reaching its Congressionally mandated threshold of 2% well ahead of schedule.

The FHA’s fiscal year 2014 actuarial report estimated it would reach the Congressional mandated 2% level during fiscal 2016, but the FHA said Monday that its latest independent actuarial analysis shows the MMI Fund’s capital ratio stands at 2.07%, well above the 2014 level of 0.41%.

This is the first time the MMI Fund has gone beyond 2% since 2008, creating a lot of buzz around whether or not the FHA should lower insurance premiums again.

"The important point is that it’s great news that the fund is over 2%, but we have to be cautious to not be overly enthusiastic,” said Stevens.

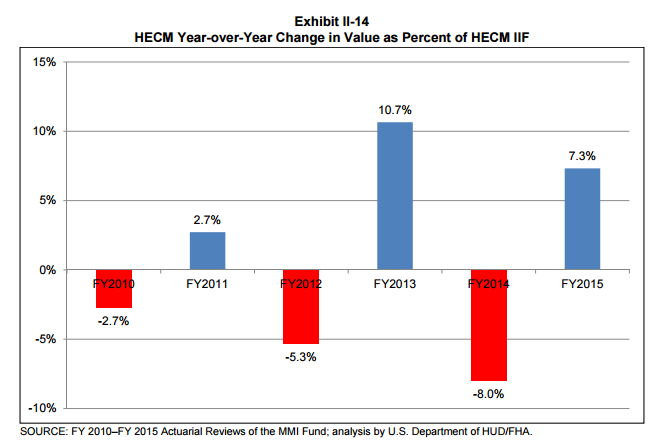

Stevens explained to HousingWire that it’s pivotal to look at what caused the surprising rise. What got the capital ratio above 2% is the Home Equity Conversion Mortgage (HECM), which has as history of wild swings.

The chart below shows the HECM’s year-over-year change.

Click to enlarge

(Source: FHA)

While HECM continues to be extremely volatile and spring back and forth, it makes up less than 10% of the entire portfolio, Stevens noted.

Carol Galante, faculty director at the Terner Center for Housing Innovation and former assistant secretary for Housing/Federal Housing (FHA) Commissioner, voiced similar concerns in her blog with HousingWire.

To those like me, who have followed closely the annual reports of past years, the results also speak to how volatile and different the Home Equity Conversion Mortgage (HECM) program (a reverse mortgage for seniors) is from the broader forward single-family portfolio. Every year since 2010, the HECM portfolio has alternated in large swings between negative and positive economic values.

Each year, even though this portfolio is only a small fraction (.1 trillion) of the overall 1.1 trillion dollar portfolio, it impacts the overall capital ratio, which is the measure most relied upon to assess the FHA.

Stevens said the FHA shouldn’t lower insurance premiums “since the capital ratio just barely made it over the line.”

“I would think that the smart move would be to continue building capital,” he said. “If we act too fast, the political ramifications can be severe.”

Stevens cautioned that unless they really need to lower premiums right now, putting the HECM into the negative and the whole program into very severe political risk in order to let the forward book keep building capital year, maybe next year or the following year would be a better.

At the beginning of the year, the Obama Administration directed the FHA to reduce annual mortgage insurance premiums by 50 basis points, from 1.35% to 0.85%.

A move that received a lot of pushback since the MMI Fund was not above the 2% threshold.

“Given that the FHA’s flagship fund – the Mutual Mortgage Insurance Fund – is expected to remain below the Congressionally-mandated 2.0% threshold until October 2016, a decision to lower FHA premiums in 2015 would undoubtedly be met by considerable opposition from Congressional Republicans,” said Isaac Boltansky, analyst with Compass Point Research & Trading, at the time.

So now that the capital ratio is above 2% some people in the industry want the FHA to lower premiums again.

Here’s a link to various industry reaction, including the a comment from the Community Home Lenders Association reiterating a call it made recently for the FHA to cut its premiums back to pre-crisis levels.

Overall, Stevens said in a public comment, “Improvements in the value of the MMI fund over the past few years are the result of a series of policy decisions designed to rebuild the fund and protect taxpayers and the role FHA plays in the housing system, particularly for low and moderate income Americans and first-time homebuyers. FHA and its leadership should be commended for protecting the program, as well as the American taxpayer.”