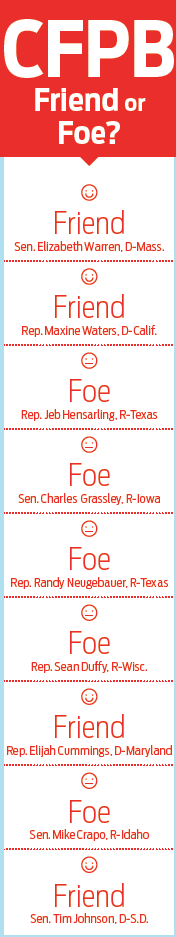

Congressional Republicans have eyed the Consumer Financial Protection Bureau with suspicion ever since it was established by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Congressional opposition to the new bureau’s supervisory role was clear when they fought the appointment of its first director, Richard Cordray, in 2011, and only intensified when President Barack Obama made an end-run around the legislature by installing Cordray through a recess appointment.

The sparring has continued with every legislative session, but seems to be gaining ground on a bipartisan basis. In the first half of the year, the House passed a bill to gain oversight of the bureau by an overwhelming majority, and the Senate is currently considering its companion bill.

It started in April, when a total of 401 members of the House from both parties voted for H.R. 1265, the Bureau Advisory Commission Transparency Act, sponsored by Rep. Sean Duffy, R-Wisc.

Just two members voted against the bill.

The bill would bring greater transparency and accountability to the CFPB by subjecting it to the Federal Advisory Committee Act.

Only three agencies are exempted by statute from open meeting provisions in the Federal Advisory Committee Act – the Central Intelligence Agency, the Office of the Director of National Intelligence and the Federal Reserve.

Since May 2014 it has been the CFPB’s voluntary policy to open full meetings of the bureau’s Consumer Advisory Board and Councils to the public, the same way most other agencies allow under the Federal Advisory Committee Act. This measure would make that a legal obligation.

Supporters of the reform note that the CFPB is not involved in intelligence collection, covert operations, or the formation of monetary policy, and therefore they argue that there is no reason that it cannot hold its committee and subcommittee meetings in public.

“What is the CFPB doing that is on par with the CIA? It makes everyone want to ask, ‘what exactly goes on in these meetings?’” Duffy has asked previously.

The CFPB has argued that it is not subject to FACA, a 1972 law that is supposed to ensure that Congress and the public know what’s being discussed in government consumer advisory meetings, who is attending them, and how much they are costing taxpayers.

Cordray said the meetings are closed to the public because the Act does not apply to the bureau.

House Financial Services Committee Chairman Jeb Hensarling, R-Texas, said at a hearing in March that the CFPB remains unaccountable and should be held to more transparent standards.

“The CFPB undoubtedly remains the single most powerful and least accountable Federal agency in all of Washington,” Hensarling said. “When it comes to the credit cards, auto loans and mortgages of hardworking taxpayers, the CFPB has unbridled, discretionary power not only to make those less available and more expensive, but to absolutely take them away.”

The legislation moved to the Senate on May 19, when Sen. David Perdue, R- Ga., introduced the “Consumer Financial Protection Bureau Accountability Act of 2015” as a companion bill.

The legislation, the senator says, would make the CFPB accountable to the American people by bringing it under the Congressional appropriations process. Currently, the CFPB operates under the Federal Reserve.

Dodd-Frank established the CFPB’s budget at as much as 12% of the Fed’s annual operating expense. That amounts to roughly $600 million per year without any Congressional oversight over the agency’s spending.

In March, Perdue offered a similar amendment that was included in the final 2015 Budget Resolution.

“The Consumer Financial Protection Bureau was spawned from the disastrous Dodd-Frank financial regulation law,” Perdue said. “Georgians sent me to Washington to help restore accountability and transparency to the federal government, and the CFPB needs a major dose of both.

“Right now, the CFPB is a rogue agency that dishes out malicious financial policy and creates new rules and regulations at whim without real Congressional oversight. The American people, through Congress, deserve a closer look at the CFPB and how its actions will impact consumers,” he said.

“Additionally, the agency itself has failed to operate within its own budget and proven it is more concerned with preserving its own power than protecting the public. Ultimately, I believe the CFPB should be eliminated, but an important first step is bringing it into the light for the American people.”

Perdue’s effort has earned support from several consumer and taxpayer advocacy groups:

“The CFPB makes all the consumer protection rules, and those rules set the tone for compliance examinations of every bank, regardless of bank size and regulator doing the exam.

“That’s why increased accountability and oversight of CFPB is so important, and we applaud Sen. Perdue for his efforts to hold this consumer agency accountable,” said Joe Brannen, president and CEO of the Georgia Bankers Association.

“That’s why increased accountability and oversight of CFPB is so important, and we applaud Sen. Perdue for his efforts to hold this consumer agency accountable,” said Joe Brannen, president and CEO of the Georgia Bankers Association.

“Instead of spending thousands of hours responding to inconsequential concerns that don’t pose significant consumer risks, traditional bankers’ time could be better spent on serving the needs of the families and businesses in their communities,” Brannen said.

Another group, the U.S. Consumer Coalition, concurred.

“The CFPB represents the greatest threat to consumer choice and freedom this country has seen in a long time. With the enforcement authority of the DOJ, and the regulatory authority of the FDIC, this unaccountable agency has limitless power to impact the lives of Americans,” said Sarah Makin on behalf of the coalition. “While there may be a role for the CFPB, we applaud Sen. Perdue for working to protect consumers from the so-called consumer protector.”

A statement from the Taxpayers Protection Alliance charges that the CFPB operates outside of the jurisdiction of Congress that most agencies operate in and continues to be appropriated by taxpayer funds without the proper Congressional oversight.

“This is an agency that demands scrutiny like any other federal agency and should be held accountable for their actions by moving into the proper process for Congressional appropriations,” said David Williams, president of the Taxpayers Protection Alliance. “Any federal agency operating with the use of taxpayer funds must be subject to oversight by the elected officials that represent those taxpayers in Washington.”

The support from those groups is countered by opposition to the bill from many consumer-advocacy groups. When the House bill was under consideration, 16 of these groups sent a letter to the House leadership touting the bureau’s success.

“Though purportedly aimed at protecting small business concerns, the amended language of H.R. 1195 threatens the ability of the Bureau to conduct rulemakings by setting caps on CFPB spending. To establish the three advisory committees for small businesses, credit unions, and community banks described in the bill, expenditures of $9 million over 10 years would be required, according to the Congressional Budget Office score.

“Offsetting these costs would severely limit the resources available to the CFPB and lead to delay of current rulemakings as well possibly prevent the implementation of future regulatory safeguards for consumers…

“In a short period of time, the CFPB has had incredible success. Its enforcement actions have resulted in $5 billion in relief for roughly 15 million people and have led to over $150 million in civil penalties for illegal corporate practices.”

As the bureau fights to retain its sovereignty, one thing is clear: The battle over its role and reach is only going to get more heated.