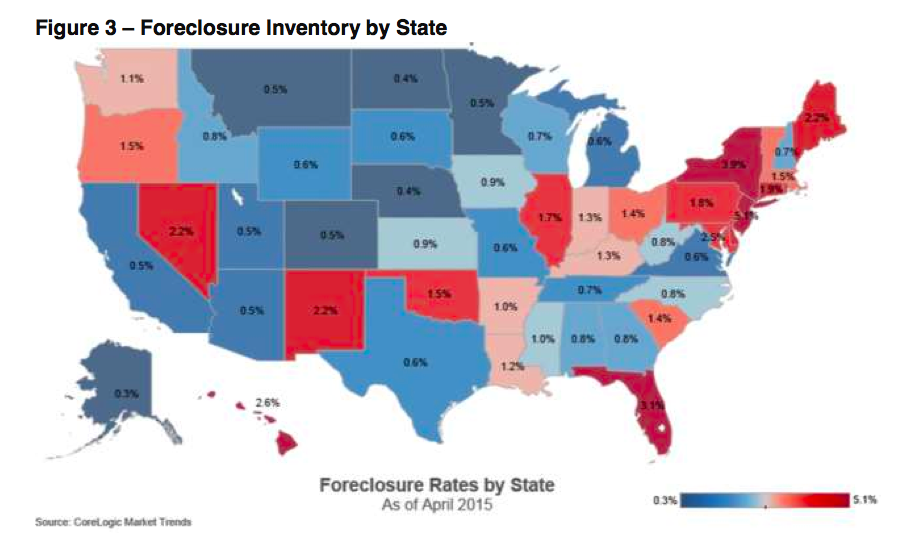

While the nation as a whole is improving from the financial crisis, the recovery still widely varies as you compare state levels.

Using CoreLogic’s (CLGX) April 2015 National Foreclosure Report, here are the top 5 and bottom 5 states with the highest foreclosure inventory as a percentage of all mortgaged homes.

Top four states and the District of Columbia:

5. The District of Columbia, non-judicial (2.5%)

4. Hawaii, judicial (2.6%)

3. Florida, judicial (3.1%)

2. New York, judicial (3.8%)

1. New Jersey, judicial (5.1%)

Bottom five states:

5. Minnesota, non-judicial (0.5 percent)

4. Colorado, non-judicial (0.4 percent)

3. North Dakota, judicial (0.4 percent)

2. Nebraska, non-judicial (0.4 percent)

1. Alaska, non-judicial (0.3 percent)

“Despite a slow and steady improvement in most housing market fundamentals, too many families remain in default of their mortgage obligations,” said Anand Nallathambi, president and CEO of CoreLogic.

“The percent of homeowners with a mortgage that have missed three-or- more monthly payments or are in foreclosure proceedings dropped to 3.6% in our April data; while well below the record peak of nearly 9% and the lowest in more than seven years, it remains about double the pre-2007 rate,” Nallathambi continued. Check out the latest CoreLogic report for more info.

This chart will help put the rest of the nation into perspective.

Click to enlarge

Source: CoreLogic

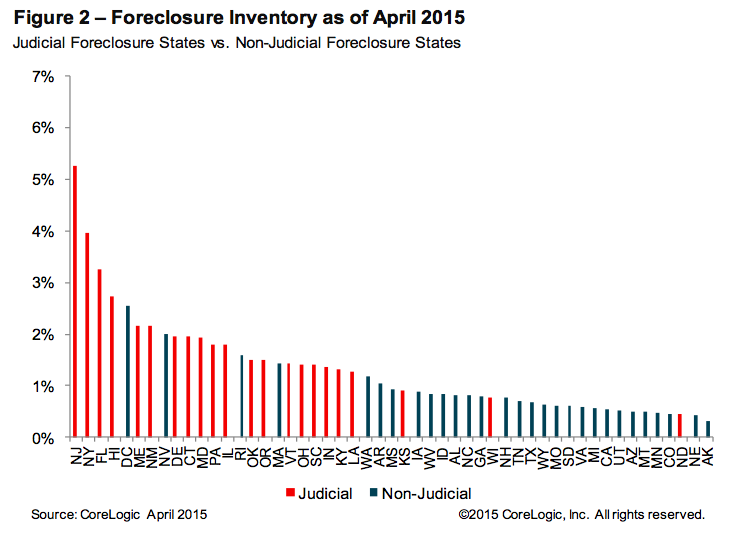

Click to enlarge

Source: CoreLogic

For a list of judicial and non-judicial states and each one's standard processing period, check this helpful page from RealtyTrac.