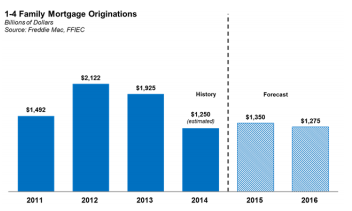

The housing market is faring better than expected this year thanks to strong refinance activity through the first four months of the year.

As a result, Freddie Mac’s May 2015 Economic and Housing Market Outlook released an updated, and more positive, forecast for mortgage originations.

This year’s mortgage originations were revised up by $50 million to $1,350 billion.

Click to enlarge

Source: Freddie Mac

Low rates also worked to push refinance volume up, increasing the forecast for the refinance share of originations in 2015 by 43%.

But despite the strong outlook, the outcome of housing in 2015 still largely rests on one questionable factor: interest rates.

“We saw housing stumble in 2013 when rates rose sharply in May and June of that year, increasing by a full percentage point over those two months. Home sales slowed significantly in response and are only now returning to similar levels," the report stated.

"Rising rates will reduce homebuyer affordability; making homeownership in high cost markets that much further out of reach. Rising rates and continued house price appreciation will squeeze affordability even in today’s low cost markets. Housing looks strong enough to weather moderately rising rates, but we need real income growth to support homebuyer demand,” it continued.

Some renowed economists do not rule out a rising interest rate environment from the Federal Reserve beginning as soon as the end of this year.

But while the comparison of 2013 to 2015 is striking, Freddie Mac stated that not all economic conditions are the same. Over the past two years, the labor market has added over 5 million additional jobs, the unemployment rate has fallen by more than 2 percentage points and housing markets are generally in much better condition than two years ago.

“Housing markets should be able to weather moderately rising interest rates if we start to see some wage and income growth. Our analysis has shown that while many markets look highly affordable today, the story can change quickly if interest rates and house prices rise without any offsetting income growth,” Freddie’s report stated.