JPMorgan Chase & Co. (JPM) is set to bring another prime jumbo residential mortgage-backed securitization to market in the coming weeks.

And for the second time in 2014, this RMBS is backed by 15-year fixed notes.

Over the course of the year, JPMorgan has brought RMBS transactions to market in varying forms.

Its first jumbo RMBS of the year was backed by fixed-rate, 30-year mortgage loans.

J.P. Morgan Mortgage Trust 2014-1 was comprised of 412 first-lien mortgage loans with an aggregate principal balance of $356 million.

Its second jumbo RMBS of the year was also backed by 15-year fixed notes. That offering was built on a pool of 544 loans with an aggregate loan balance of $303.75 million.

In September, JPMorgan broke new ground with a jumbo RMBS backed entirely by hybrid adjustable-rate mortgages. J.P. Morgan Mortgage Trust 2014-IVR3 was backed by a pool of 551 loans with an aggregate loan balance of $483.56 million, and each of the loans is a 30-year ARM in various forms.

Earlier in October, it brought J.P. Morgan Mortgage Trust 2014-OAK4 to market. The offering was built on a pool of 434 loans with an aggregate loan balance of $355.64 million and was backed by the more traditional 30-year, fixed-rate mortgage loan.

A pool of 373 loans with an aggregate loan balance of $262.23 million backs its latest offering, J.P. Morgan Mortgage Trust 2014-5. Each of the underlying loans is a 15-year fixed-rate mortgage.

The pool carries an average loan balance of $703,029 and a weighted average loan-to-value ratio of 55.9%. The underlying borrowers have weighted average original FICO score of 763 and a WA current FICO score of 762.

Fitch Ratings and Kroll Bond Rating Agency both issued presale reports to JPMMT 2014-5 and awarded AAA ratings to the majority of the tranches of the deal.

Fitch cited the fact that all of the underlying mortgages is a 15-year note as a positive rating driver.

“The collateral pool consists of 15-year fixed-rate mortgages to borrowers with very strong credit profiles, low leverage and substantial liquid reserves,” Fitch said in its presale.

“Third-party loan-level due diligence was performed on 100% of the pool, and Fitch believes the results of the review generally indicate strong underwriting controls. Fitch’s probability of default for 15-year FRMs is lower than that for loans with 30-year terms to reflect the positive selection associated with borrowers who select the higher payment, which results in faster amortization.”

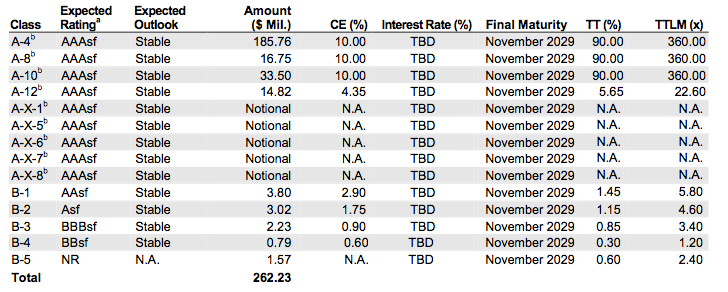

Click the image below for Fitch’s anticipated ratings of the deal.

KBRA also noted the quality of the collateral as a positive. According to KBRA’s report, JPMMT 2014-5 has the lowest WA LTV and combined LTV of any post-crisis, prime jumbo RMBS transaction it has rated.

“The quality of the borrowers in JPMMT 2014-5 is strong, as evidenced by WA original and current credit scores of 763 and 762, respectively,” KBRA said in its report. “Income and assets for all borrowers have been well documented and verified. Despite relatively high borrower incomes, most loans bear prudent debt-to-income ratios, with a WA DTI of 28.8%.”

On the other hand, and as has become customary with jumbo RMBS transactions, both agencies caution on the geographic concentration of the deal.

Given the cost of homes in California, it should come as no surprise that the Golden State ranks first with 48% of the underlying properties. New York ranks second with 11% and Texas ranks third with 7.5%.

“In addition, 50.6% of the properties are located in the pool’s top five metropolitan statistical areas in n California, New York and Illinois,” Fitch said. “The pool has significant regional concentrations, which resulted in an additional penalty of approximately 7% to the pool’s lifetime default expectation.”

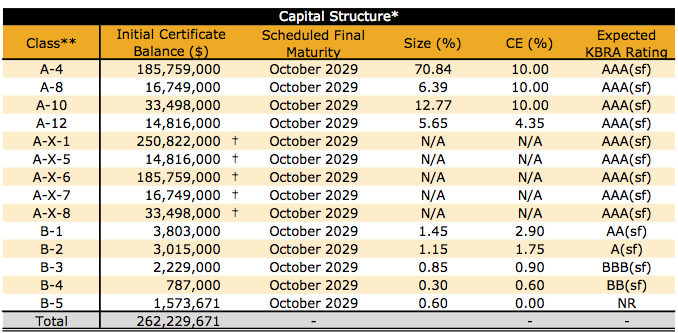

Click the image below for KBRA’s ratings.

Also of some concern is the representations and warranties framework of the deal. According to KBRA’s report some of the reps and warrants in the deal will sunset prior to the maturity of the certificates.

“While the transaction benefits from JPMorgan Chase Bank and First Republic Bank as representation and warranty (rep and warranty) providers for approximately 91% of the pool, Fitch believes the value of the rep and warranty framework is diluted by the presence of qualifying and conditional language in conjunction with sunset provisions, which reduces lender breach liability,” Fitch said in its report.

“While the agency believes the high credit quality pool and clean diligence results mitigate these risks, Fitch considered the weaker framework in its analysis.”

Also of note is the presence of several large loans in the portfolio.

“JPMMT 2014-5 has eight loans with current balances greater than $2 million; three of which are above $3 million and make up 4.0% of the pool,” KBRA said. “The largest loan is $3.66 million, which represents approximately 1.40% of the mortgage pool. The second largest loan is $3.60 million, or 1.37% of the pool. The risk associated with large loans in this pool is addressed through KBRA’s large loan stresses, discussed herein, which increased the ‘AAA’ loss level by 223% from the model results.”