Perhaps no proxy for U.S. housing is more direct than Realogy Holdings Corp. (RLGY), which first went public in 2012 and bases its entire business model off of real estate transaction volumes.

The company owns, operates and/or franchises multiple real estate brands including Century 21, Coldwell Banker, ERA, Sotheby’s, and Better Homes and Gardens Real Estate — plus operating a title business, relocation services, and REO/foreclosure management for institutional clients.

Bottom line: the company’s brands touch most of the recently wobbly U.S. real estate sector. So is now the time to make a bet on Realogy?

THE BEAR CASE

Realogy’s first-quarter earnings tell investors everything they need to know right now. And what do those earnings say? Stay away.

The company’s shares tanked 13% — the most since the company’s October 2012 IPO — almost immediately on the heels of a 32 cent per-share loss booked in Q1 2014, far more than the 19 cent per-share loss analysts had expected.

Realogy said the number of transactions in its franchise group dropped 3%, while it’s NRT brokerage unit saw volume fall a similar 2% versus one year earlier.

Lower transaction volume typically means a drop in earnings at Realogy, and that’s exactly what we saw happen, even as the mix of properties sold shifted toward higher-priced properties. (Don’t mistake a mix shift to higher-end sales to mean more higher-end homes are selling; it just means the bottom has dropped out of the mid and lower tiers.)

The company says it expects the slowdown to persist all year.

This “could be a challenging year, especially if transaction volume growth continues to slow throughout the prime selling season,” Realogy Chief Executive Officer Richard Smith said on a conference call with analysts.

“The challenges of low inventory at the first-time homebuyer and move-up buyer levels are compounded by tough credit underwriting and the effects of a sluggish economy, which we believe has slowed demand.”

“There are those who believe that this is going to be a delayed spring, especially in the Northeast and major parts of the Midwest,” he said on the call. “We’re assuming that’s not going to happen. If it does happen, it’s upside.”

In other words: if you thought Q1 was a bump in the road, get ready to be surprised when Q2, Q3 and Q4 are all possibly even worse than what we saw during the first quarter.

And with tight mortgage standards now firmly legislated in place, don’t look for lenders to open up the spigot anytime soon to enable more mortgage production and more home sales. Ditto for stagnant earnings and slow household formation rates, all affecting demand for new homes as well as the ability of would-be borrowers to access needed financing.

It’s awfully difficult right now to find drivers of near-term growth in real estate activity when looking nationally — and irrespective of local market conditions that may be comparatively better or worse, it’s this amalgamated sort of “national market” that drives Realogy’s earnings.

With housing not looking so rosy in the near future, now’s not remotely the right time to throw any chips on the table relative to growth in the U.S. housing sector.

THE BULL CASE

Bears can point to a slowdown in U.S. real estate as a reason to stay away from Realogy. But the truth is that the company is positioned to weather the near-term storm while reaping longer-term gains when the market returns to a more stable outlook.

First of all, any downside is already priced in. Shares were hammered after the company’s first-quarter earnings report — so much so that investors immediately began buying the dip, according to data from OptionMONSTER.com.

Call option activity on Realogy common stock surged, for example, providing cheap upside exposure for investors. Overall option volume surged 32 times the stock’s average activity in the wake of the company’s earnings report, with 73% of options representing calls, according to optionMONSTER.com.

In other words: sophisticated investors clearly don’t see Realogy’s rough first quarter as a sign of trouble ahead and are willing to take a chance.

Secondly, while profit at Realogy during Q1 missed forecasts, some have already forgotten that the company’s Q1 revenue actually beat Street estimates despite prevailing headwinds in the U.S. housing sector.

Given that the company has already said it’s expecting nothing in the way of a spring bounce for housing sales, it would follow that the company’s executives have already adjusted their operating philosophy to account for this reality — which could lead to better results than most are expecting in the quarters ahead.

Don’t forget: just because housing is down doesn’t automatically mean Realogy is out.

The company maintains significant ability to adjust its operating profile to match the current market environment, especially through the company’s owned-brokerage unit, NRT.

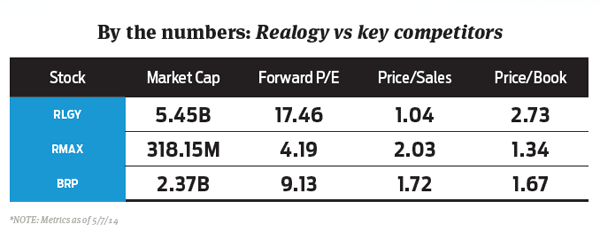

Lastly, a look at the numbers suggests that investors remain extremely bullish on the company’s future profit prospects: Realogy’s forward P/E is significantly greater than its two major publicly traded competitors, RE/MAX Holdings and Brookfield Residential Properties.

At a market price 17.46 times forward earnings, even after taking a hit in value after the most recent earnings report, it’s clear that investors are expecting greater things from this company in the future — regardless of external market conditions.

It’s usually not wise to bet against the market in the long term, and it’s likely that investors trying to outsmart the market here are going to find themselves burned at some point as a result.

Editor's note: Each month, HW Magazine publishes a non-bylined column called The Angle that looks at a publicly-held company in the housing economy and presents a bull and bear investment case. HousingWire does not take a position on the stock being analyzed, and leaves it up to the reader to independently determine which case is most persuasive for their own investment objectives.