In the world of public relations, not every foreclosure is treated equally. This is especially true when it comes to military affairs, where a lender’s failure to delay a foreclosure or lower an interest rate as required by federal law quickly turns into a public relations disaster for whichever bank or servicer is caught distributing the final foreclosure notice.

The American military is often sent for months at a time overseas and perennially challenged by permanent change of station orders, which require cross-country moves at short notice.

Federal law through legislation, such as the Servicemembers Civil Relief Act, is designed to grant foreclosure delays and postpone certain financial commitments when a member of the armed services is on active duty.

Most lenders try to avoid mistakes when it comes to servicing the loans of active military members like the plague, but making sure the I’s are dotted and the T’s are crossed requires much more than just reaching out to borrowers.

With so many military men and women overseas, it’s important to fine-tune in-house compliance systems and ensure your team is well aware of all the challenges, say attorneys who handle military affairs daily.

Back in 2011, a few financial firms found out the hard way that it’s much more difficult recovering from the fallout of a wrongful foreclosure on a military member than it is to set up the best compliance systems.

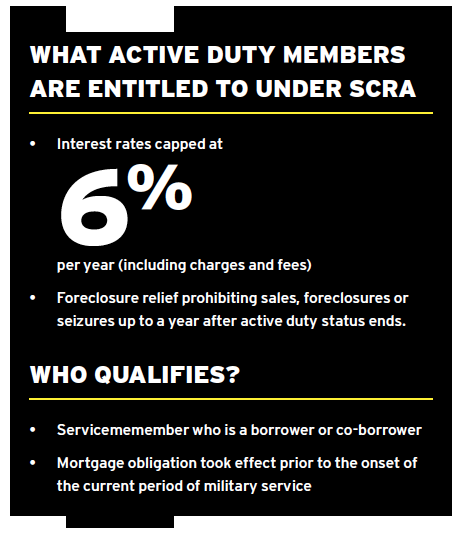

As HousingWire reported three years ago, JPMorgan Chase had to recover from allegations that it overcharged 4,000 troops on their mortgages and improperly foreclosed on 14 military families. The Servicemembers Civil Relief Act (SCRA) stipulates that lenders have to lower mortgage rates for active-duty military members to 6% and must delay foreclosures during the military activation period.

As HousingWire reported three years ago, JPMorgan Chase had to recover from allegations that it overcharged 4,000 troops on their mortgages and improperly foreclosed on 14 military families. The Servicemembers Civil Relief Act (SCRA) stipulates that lenders have to lower mortgage rates for active-duty military members to 6% and must delay foreclosures during the military activation period.

Back in 2011, news reports slammed JPMorgan Chase on allegations that a marine’s interest rate was kept well above the 6% threshold.

The Consumer Financial Protection Bureau, created in 2010 to enforce portions of the Dodd-Frank Act and oversee the lending space, ended up seeing military lending and servicing as an important enough issue to launch a separate unit within the agency to oversee military affairs.

The division, led appropriately by Holly Petraeus, the wife of retired military Gen. David Petraeus, is there to monitor the treatment of active duty military. In an interview with HousingWire, Petraeus said in the past few years, improvements have been made in dealing with service members. She was appointed director for the Office of Servicemember Affairs for the Consumer Financial Protection Bureau a few years ago.

But she’s not confident about the servicing function, especially when it comes to ensuring the person on the other end of the line understands the nuances of dealing with a military member in financial distress or who is requesting provisions outlined under the act and federal law.

“We still see issues basically with customer service in the servicing of the loans,” Petraeus said. “There is a tendency to have the service member jump through extra hoops if the service member is deployed. It can be difficult to get the servicer to deal with them.”

Petraeus says the real issues popped up a few years back when attention was drawn to the fact that lenders were not always giving qualified service members the SCRA rights that they were entitled to.

Cases like the JPMorgan situation and the publicity around the Act and the rights granted to service members led to steady improvements, she said.

“I think there has definitely been improvements since the big blow up when they realized that they were not doing the right thing. A number of them have put procedures in place,” Petraeus said.

Those procedures often include a special point of contact for military customers and better scripting and training for customer service representatives who deal with members of the military who have protected rights and options as soon as they pick up the phone and call in.

Issues still pop up, said Petraeus. It all goes back to who picks up the phone and do they understand what each military member is qualified for?

“We still occasionally hear stories where someone (on the other end of the line) is saying you only get that if you are in a combat zone,” Petraeus noted.

But that’s wrong, she said. You get the benefits when you are active duty, and there is “still some misinterpretation” of the rules and wrong information reaching customer service reps, Petraeus added.

From Petraeus viewpoint, it’s worthwhile to ensure the person dealing with active duty military members understands the various classifications and orders. It may be a case where the customer service representative gets only one chance to make the right decision before embarrassing the company.

From Petraeus viewpoint, it’s worthwhile to ensure the person dealing with active duty military members understands the various classifications and orders. It may be a case where the customer service representative gets only one chance to make the right decision before embarrassing the company.

“I would say that when someone raises their hand and volunteers to serve our country, we should not be making it harder for them to keep their financial concerns in order,” Petraeus said.

Keith Anderson, an attorney with Bradley, Arant, Boult Cummings, is familiar with the best way to comply. As an attorney, he has assisted firms with compliance and is well versed in the Servicemembers Civil Relief Act.

The biggest thing to know is the parameters of protection offered to active duty military, he said. It used to be the protected service period — that enforced foreclosure delays for those on active duty — lasted only nine months after the end of service, now it’s 12 months after the time of service ends.

So essentially, a protected service member is currently protected from foreclosure or losing their home during their service period and 12 months after that period of service concludes.Freddie Mac clearly outlines all the rules associated with SCRA on its website, noting that the law not only caps interest rates at 6% per year (including charges and fees) on mortgage obligations during the service period, it also delays it up for one year after the service period ends.

Foreclosure relief also is granted, prohibiting the sale, foreclosure or seizure of properties belonging to those on active duty.

As far as who is eligible, Freddie Mac says SCRA protections are met if the service member is the borrower or co-borrower and assumed liability for the mortgage, and the mortgage obligation took effect prior to the onset of the current period of military service.

Attorney Keith Anderson says lenders and servicers overall show a great propensity toward getting this right or wanting to get this right. When asked about how common litigation is in this area, he says, “I would say it’s not very common. It’s not extremely prevalent. Most lenders and servicers do comply with it.”

He added that when there are those situations where a potential violation pops up, in his experience, the financial institutions “will correct it and do it right.”

He always reminds financial firms that in a “judicial foreclosure context, you have to file a military affidavit if you are seeking a default.”

SPEAKING THE MILITARY LANGUAGE

Both Petraeus and Anderson concede that one area of concern is determining whether a military member is qualified as active duty, making the SCRA applicable.

“One of the challenging areas is that there are a lot of different classifications for military people,” said Anderson. “You have some strange classifications.” A person on staff needs to understand those classifications to ensure the first rule of eligibility is determined.

“Those situations are going to be pretty rare, but they do come up. If you have individual, unique classifications, you have to take a second look at it and have someone familiar with classifications weigh in.”

Petraeus also sees this as an area of concern. The best way to mitigate it is to have a point of contact in mind, who has the military knowledge or enough training to step in, she advised.

“I think part of the intent was not to only have someone who understand the SCRA, but who also understand the military. That is a separate world in many ways with its own language and requirements,” she noted, adding that it helps if the person on the other end of the line understands what being activated means and what PCS orders are.

Petraeus says confusion about who is active duty was one of the first issues she addressed in her role at the CFPB. She remembers Congressional testimony in which a JPMorgan Chase vice president showed up to discuss military status issues. She remembers him saying, “They found the orders complicated.” This is especially true when it’s a national guard member or a reservist who are prone to going on and off-duty.

Petraeus says she cannot stress enough the need to make sure the customer service agent is not in the dark or leaving the borrower in the dark.

Some recent complaints have included military members being told to provide paperwork that is not needed or given inaccurate information about what they qualify for.

“Servicemembers (in some cases) are being told they have to provide certified orders or letters from their commanding officers and an order with an end date, which they don’t get,” Petraeus said.

“The bad practices are still out there, but I do think the large mortgage lenders are certainly more aware and they have tried to put mechanisms in place to do a better job.”

BLIND SPOTS

Verifying who is active duty military is the lynch pin in the process. Servicers and lenders who get this part right will generally be empowered to make the correct decisions.Anderson and Petraeus both point to the Defense Manpower Data Center, a website where a military member’s current status can be checked using a Social Security number, date of birth and their last name.

Anderson says, “You can punch it all in and see what their status is going back one year.”

He noted that the functionality of the DMDC website changed in April 2012. Under the old system, a bank could only check what the current status is, while the expanded version allows someone to enter data and check on what an individual’s status was in the past.

Anderson said right now, the site is “pretty accurate.” However, he notes a few glitches popped up with historical data going back as far as 2005 and 2006 when financial firms were trying to determine a person’s past status.

He admits though that the data is pretty accurate today. However, he has found a few instances “where the data was questionable — and you may have a printout under the previous version, and the two data sets were not congruent.”

The takeaway from this is trust the data, but verify it when in doubt. This is especially true when the party doing the checking is unsure about whether the status equates to active duty and when digging into the system for older information, legal analysts say.

Petraeus says the DMDC site has made it easier for servicers since they can now put in a big batch of names and search for a large number of military members at once, rather than plugging in each person name-by-name.

“It should be much easier for them to see who among their customers is on active duty and find out if they have a pre-existing mortgage that should be covered,” Petraeus said.

BEWARE PUBLIC RELATIONS

It’s easy to mess up unintentionally, but within this context, the political and public relations ramifications are amplified due to the nation’s sensitivity when it comes to military matters.

This is why Petraeus recommends taking no chances when it comes to who is allowed to serve as a military point of contact. She recommends having enough staff or qualified reps who can handle these calls — or who know who to send these calls to when a situation turns up.

Anderson also sees how the fallout from a minor, unintentional mistake can reverberate across the industry.

“It’s a sensitive topic, and I think when the military borrower comes up, people’s antennas have to be fine-tuned,” he said. When the five big servicers settled with prudential regulators on servicing issues, the consent decrees addressed some of these concerns through look-backs and expanded coverage for people in hostile fire zones,” Anderson added.

But he’s optimistic that it’s not a major issue with most financial firms consciously fighting to stay in compliance.

“Servicers and lenders are aware of it now and ought to comply with it and are doing a good job,” Anderson noted. He points out that many of them have developed in-house procedures to ensure compliance.

As for what servicers and lenders can do, a checklist is a must, suggests Anderson.

“I’ve done my share reviewing policies and procedures for different lenders,” he notes. “It all has to be on a checklist.” That list will ensure in-house staffers know how to do a military search on a borrower and what issues might surface in terms of confusing information.

If a foreclosure is in a judicial state, not only does the servicer have to check the Defense Manpower Data Center to confirm the status of the military member, the data from the DMDC confirming the person’s status can be attached to the actual affidavit filed with the court.”

If more obscure parts of the SCRA act are raised, Anderson recommends having a contact, preferably someone in house, familiar enough with the entire act to ensure compliance with all standards.

While there are rarely lenders and servicers who deliberately try to misguide military members, something as simple as failed processing or the wrong person on the line can turn a simple servicing initiative into a much larger issue.The takeaway: Check everything twice and keep staff members handy who know how to deal with military affairs. Perhaps, the biggest piece of advice from experts in this area is to assume nothing. If something is confusing to a party on staff, make sure they are empowered and knowledgeable enough to reach out to a contact who can assist them in taking the right steps.

From a PR standpoint, it’s one of those areas where you have only one chance to get it right.