This time last year, HousingWire Magazine made a call that was controversial to many in the mortgage industry and especially in default servicing.

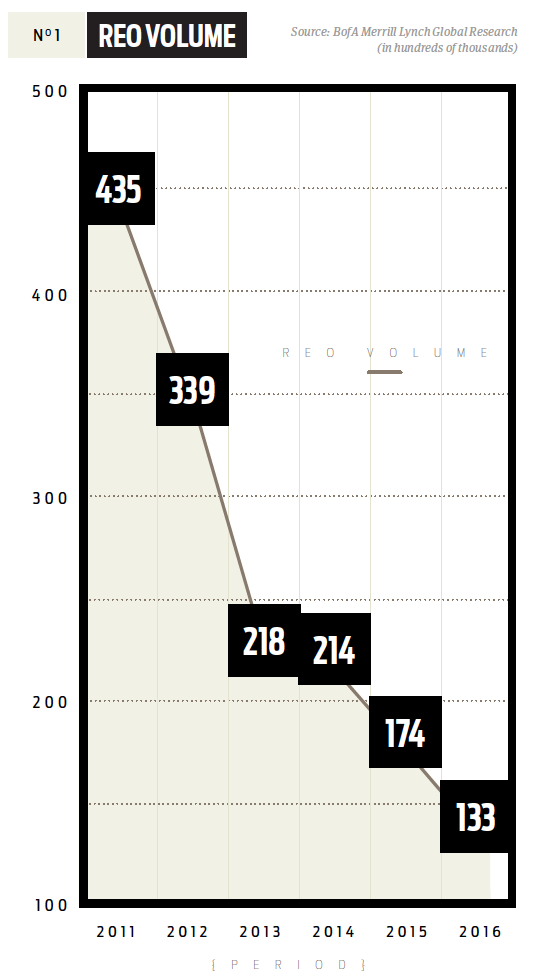

The call is that bank-owned REO was dead, and soon too would be the majority of the REO outsourcing industry before this year was out. (See Chart No. 1 on REO volumes, below.)

Plenty of REO outsourcers didn’t want to hear it, least of all from an industry rag, and argued instead that the foreclosure process was going through a temporary lull.

Now, many of those same outsourcers are significantly smaller or out of business altogether — and it’s taken as gospel by most reasonable real estate experts that the boom REO market through 2011 won’t be seen again any time soon.

As we look into our crystal ball for 2014 at HousingWire, we see even more upheaval and change ahead. Those in the mortgage industry who are fans of the status quo likely won’t like much of what 2014 has in store — but those who plan smartly, adeptly adjusting to industry trends, will find 2014 will present opportunities that may not be seen again in a decade (or more).

JOBS: PERCEPTION, MEET REALITY

Any discussion about mortgages and housing should start with jobs. Without a vibrant job market, household formation stagnates — to say nothing of the incomes needed to actually afford a home. And so how have we been doing on that front? It’s not as pretty as the popular press might want you to believe, where headlines routinely blare that the jobless rate has retreated from the 9-plus% last seen in mid-2011 to 7.3% this past August.

The reality about the U.S. job market is just below the surface of these headlines, and is unfortunately far less positive. More than 90 million U.S. workers are no longer in the U.S. labor force, a trend that has helped push the labor participation rate to below 63% for the first time since March of 1978 — nearly 35 years ago.

While some of this is undoubtedly due to Baby Boomers retiring, the vast majority of the decline in labor participation rate is tied to those unable to find work and simply giving up, according to U.S. Census Bureau data.

With such a low labor participation rate, our nation’s unemployment rate has been going down simply because the denominator in the unemployment equation — the size of the active U.S. workforce — is shrinking.

That’s faux economic improvement, and it’s why this recovery feels so hollow for so many of us. It’s why more than one in seven Americans are now on food stamps to make ends meet.

THE PART-TIME ECONOMY

It’s tough enough with discouraged workers dropping out of the workforce in numbers not seen for more than three decades, but for those lucky enough to find jobs in this nascent economic recovery, even these jobs often aren’t what they’d otherwise like to have.

In October 2013, the estimated number of Americans working part-time for economic reasons — code for “couldn’t find full-time work, so took a part-time job” — rose to 6.41 million, up from 6.18 million the month before. That’s more than twice the long-term, pre-crisis average.

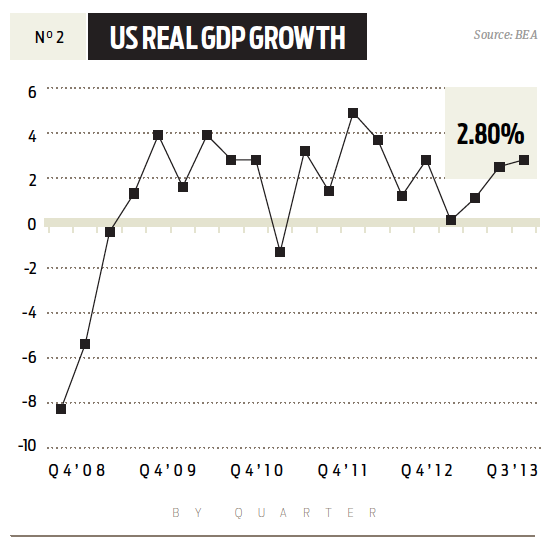

Some recovery. And it’s little wonder, then, that gross domestic product, the primary aggregate measure of economic activity in the U.S., has been hovering at anemic levels not usually associated with a post-recessionary period.

The most recent third quarter 2013 initial estimate of U.S. GDP growth stands at 2.8%, a number that appears rosy in light of the fact that most economists were expecting an initial read to come in far closer to 2%. (See Chart No. 2, left.)

But as with jobs data, it’s what it just below the surface that matters most. Almost an entire point of that quarterly gain came as businesses built up inventories during the quarter — a move likely to stymie further expansion during the current fourth quarter. Further, the annual rate of growth in consumer spending fell to just 1.5%, the weakest quarterly increase in more than two years. And at the same time, spending by the federal government fell 1.7%.

Think the recent shutdown of the government and brinksmanship over the debt ceiling helped matters here at all? (Easy answer: not a chance.)

The picture that emerges is an economy in full “muddle-through” mode: where job growth isn’t negative, at least, but isn’t strong enough to keep pace with population growth; where many jobs that do exist aren’t at the rate of pay consumers previously enjoyed; and where economic results aren’t as strong as would typically be expected in a post-recessionary period.

THE MORTGAGE MARKET

As we’ve seen, jobs remain a problem during this recovery. And without jobs, demand for purchase mortgage transactions is going to remain weak — at best. That’s tough news for both mortgages and for housing in general.

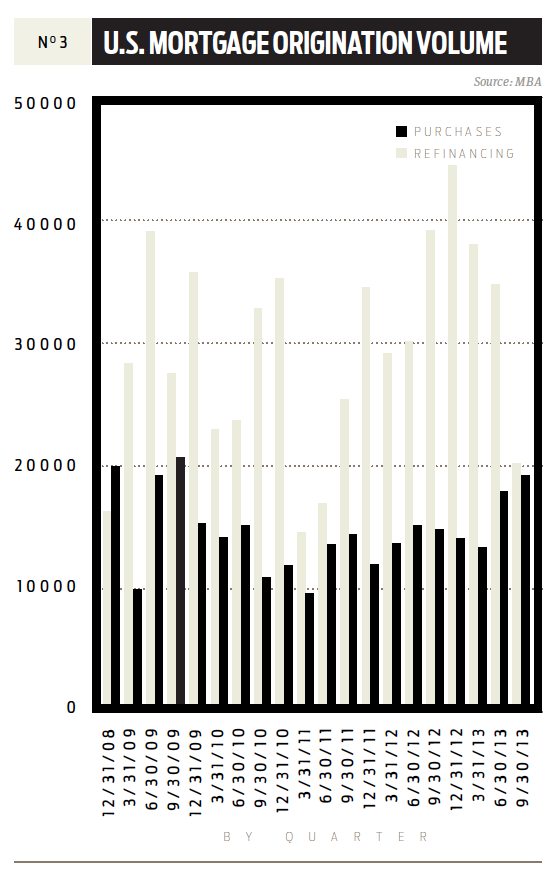

This is a harsh reality for mortgages because purchases are such a small part of the overall mortgage market, even in the best of times. And our industry has enjoyed the fruits of a ramped-up refi boom for the past year or so — a boom that is decidedly now over. (See Chart No. 3 on right, mortgage origination by volume.) The refi party ended in the middle of 2013, and abruptly at that. Most in the industry are well aware of the burnout, and have seen (or been impacted by) the large layoffs absorbed by most major lenders as a result; most also already know that rates have jumped up above levels they were at earlier in the year.

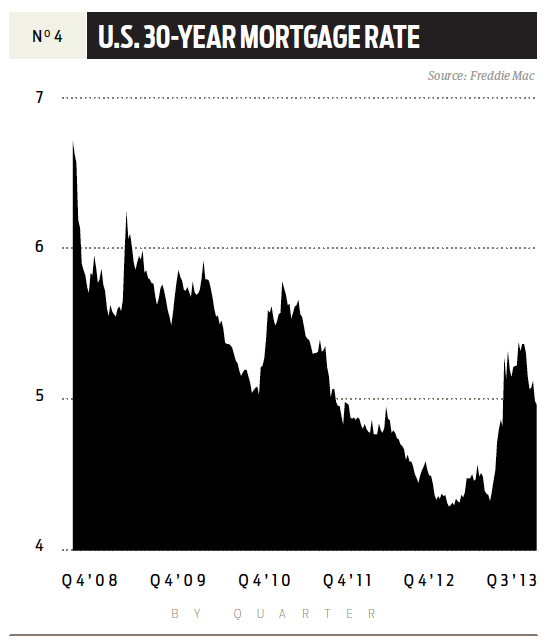

Rates are expected to continue their increase as we head into the new year, although the pace at which that increase occurs is currently anyone’s guess. The National Association of Realtors has projected that 2014 will see rates move into the mid 5% range, for example. Seems reasonable.

While most agree rates will continue to rise, the pace of change in the primary U.S. mortgage market is extremely sensitive to the Federal Reserve’s continued purchasing of mortgage assets — the duration and scale of any planned tapering efforts to back off of that purchase program will drive further rate increases for the primary market, and bears significant attention as the Federal Reserve sees Ben Bernanke’s term come to an end. (See Chart No. 4, U.S. 30-year mortgage rate, on left.)

The directional movement in rates means the focus in the U.S mortgage market is already shifting to the much-smaller purchase mortgage market space — a space heavily constrained by extremely conservative underwriting standards, and a space almost entirely dependent on job growth and household formation.

Which is to say that 2014 is likely going to be a much tougher year for mortgage bankers and brokers alike.

THE HOUSING MARKET

Things look a little different when stepping out of mortgage-land and looking at housing — that’s because the only mortgage business that directly matters to housing’s fundamentals is purchase money. Refis are merely financial alchemy.

And here there is some good news: Home prices and sales volumes are up.

In fact, according to the S&P/Case-Shiller 20- city composite, home prices were up 12.7% at the end of August from where they stood one year earlier. While prices remain well off their pre-crisis highs — meaning anyone concerned about another “bubble” is likely not taking a long enough view — the recovery in most U.S. housing markets has been palpable.

And there’s more good news: existing home sales volume is up, tracking close to 5.3 million units at an annualized pace during the most recent September data. That’s an increase of 10.4% from the 4.8 million unit pace recorded one year earlier.

New home sales are up, too, most recently hitting a 421,000 unit annualized pace at the end of August. That’s up 12.6% year-over-year, although it’s still well below the 800,000 to 1 million annualized pace builders historically kept from the late 90s up until the crisis hit in mid-2007. And in a market where more than 5 million existing homes will change hands this year, new home sales will likely represent less than 10% of that total.

So what’s driving price gains in U.S. housing markets? That’s easy. Without economic growth and jobs, the U.S. consumer is largely sitting on the sidelines of this recovery round; and with new home sales improving but still well below pre-crisis levels, it’s resale of existing inventory that is driving much of the national pricing gains.

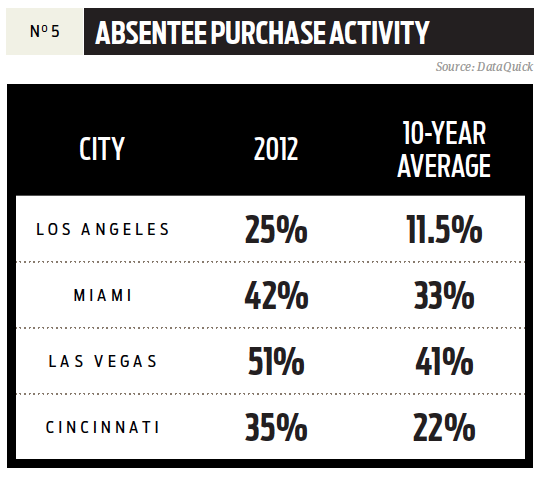

Investors are buying homes. A lot of them. In many markets, absentee purchasers — those who have their tax bill sent to a different address — are more than 10 points above historical averages. (See Chart No. 5, absentee purchase activity during 2012, left)

While a flurry of investor activity has helped fuel recovery in the nation’s housing markets, few expect it to be sustainable for very long. Investors typically don’t drive sustained activity in any housing market over time.

Analysts at Bank of America Merrill Lynch Global Research, for example, recently estimated that after seeing home prices appreciate roughly 12% this year, next year that appreciation will fall to half of 2013’s pace — and by 2016 home price growth will again be in negative territory.

WHAT ABOUT DEFAULTS?

Many in the default servicing marketplace — vendors, particularly — are yet hoping for a backlog of foreclosures to being moving forward again. While to some extent that will occur, we don’t see that as a major force going forward; and the firms planning for such activity are likely to find themselves in a tough spot next year.

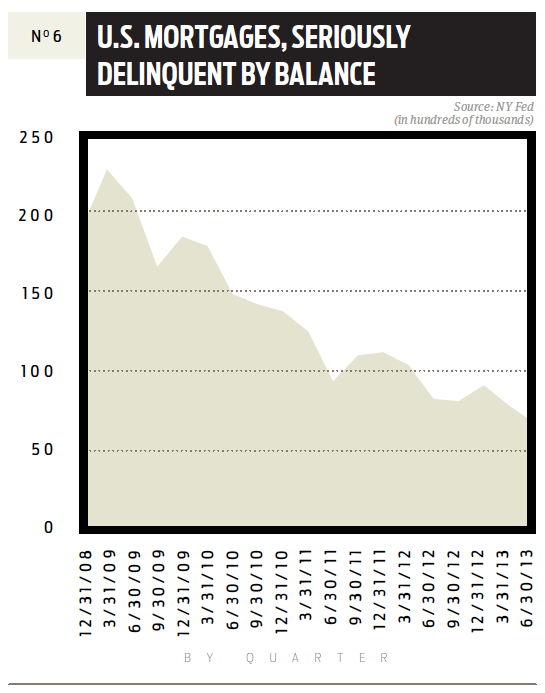

Here’s why. While seriously delinquent mortgage balances remain elevated, at $67.27 billion according to data provided by the Federal Reserve Bank of New York — a level that is two to three times historical averages — delinquencies are trending downward quickly.(See Chart No. 6, U.S. mortgages, seriously delinquent by balance, right.)

And for those properties that are currently in default, data clearly shows that they tend to stay in default longer than ever before. According to CoreLogic, roll rates (which measure transition of a loan from one status to another) recently hit all-time lows for both 90 days delinquent to foreclosure, as well as in foreclosure to REO rolls. The 90-day delinquency to foreclosure roll rate is just above 5%, meaning 95% of the loans in serious delinquency aren’t rolling into foreclosure.

Nor, increasingly, will they ever be. Foreclosures are taking longer than ever to manage, with judicial foreclosure states now taking an average of 37 months to clear and nonjudicial foreclosure states taking 27 months.

Map onto that trend the emergence of a so-called “reverse roll” — where a loan goes backward in the pipeline process — and foreclosures just don’t seem likely to become the mass threat they once were for housing. CoreLogic data shows that reverse rolls out of the foreclosure bucket and back into delinquency (pre-foreclosure) bucket have spiked to all time highs, reaching nearly a 10% rate in the middle of 2013.

It’s a trend that seems likely to continue into 2014 as more programs are put in place to find alternative disposition approaches, and as the burden of managing foreclosures becomes even more costly for lenders and servicers.

The foreclosure crisis is officially over. For now. As recent home prices gains moderate and eventually turn negative in the next few years, we will see more loans begin to enter the default pipeline. But for 2014, that isn’t in the cards.

At the same time, however, the pain for investors and servicers managing a backlog of currently delinquent assets may actually just be beginning — recent price gains are already slowing, which had helped investors and homeowners alike by keeping severities down. With price gains now moderating, loss severities will be on the increase, and perhaps exponentially so given the long lag times in processing a foreclosure.

IT ALL COMES DOWN TO THE CONSUMER—AND REGULATIONS

So, to recap: Job growth has been weak; economic growth, tepid; new homes sales, improving but not nearly enough to matter in the overall housing picture; existing home sales have been recovering, but largely due to investor influence, which is set to begin waning in 2014; and default activity remains in the deep freeze. Where does this leave us?

It leaves us in the hands of the very consumer that remains largely economically hobbled.

The time for smoke and mirrors is over, as we head into 2014: we’ve largely been able to manipulate our way to housing market growth, and the Federal Reserve under Ben Bernanke has proved itself surprisingly adept at doing so. In 2014, we’ll begin to see what happens when the training wheels are taken off of the U.S. mortgage market. We’ll see if the U.S. consumer is strong enough to ride under their own power.

The looming threat of a government shutdown, therefore, is a major threat to any continuing recovery. Goldman Sachs analysts have estimated that if a shutdown event led the U.S. to default on its debt on its debt obligations, our country would absorb at -4.2% hit to GDP — an instant recession.

The recent debt deal passed by Congress merely stalls the debate until early 2014. And the outcome of this game of political brinksmanship will have direct consequences not just for housing, but also for an entire mortgage industry that more than any time in the past five years will be dependent on purchase money to keep the lights on.

At the same time, the mortgage market is digesting some of the most significant regulatory changes in its history during 2014. The Qualified Mortgage and Ability to Repay rules are set to go into effect in January as part of the Dodd-Frank Act, and a recent study by data firm ComplianceEase found that a full 1/5 of purchase money loans originated this year would not qualify for the safe harbor next year.

The effect here should be clear: The U.S. mortgage market will shrink during 2014 in total. Forecasts from the Mortgage Bankers Association bear this view some credence: the MBA estimates that originations will drop 32 % in 2014, to $1.2 trillion in total. Purchase originations are expected to rise to $723 billion, up from an estimated $661 billion this year; but refinance activity is expected to tumble to just $463 billion, far off the $1.08 trillion expected this year.

And the changes portended by Dodd-Frank are just the start of external forces pushing the mortgage industry in 2014. Upcoming Basel III risk & capital rules are likely to see banks less enthusiastic about holding onto servicing rights, too — as well as less likely to restart private-label securitization activity, given the risk-retention requirements included in Dodd-Frank.

This outlook isn’t intended to be a treatise on the effects of upcoming regulation on an industry, beyond noting that regulation tends to restrain economic activity in sectors where it is most heavily applied. Mortgages seem a likely candidate for just such an outcome during 2014.

The truth for 2014 is primarily thus: We are entering a period of large-scale shift in mortgage banking, and a period of uncertainty. It’s possible that the shifts we see beginning in 2014 will rival the industry upheaval seen during the financial crisis — or worse, depending on how the political winds on Capitol Hill blow relative to the future of Fannie Mae and Freddie Mac.

But as an industry stares into the cauldron of uncertainty for 2014, it’s important to remember this: from challenges, opportunities always emerge. And the need for housing is fundamental.

The golden age of bank-led mortgage finance is likely coming to an end, as banks will increasingly hem their lending efforts towardQM-eligible lending. This means there exists a massive opportunity for nonbank financial institutions to take share in the U.S. mortgage market; a trend that seems like to completely remake the market for mortgages over the next few years for those firms that can pave such a path successfully.

It also means the mortgage market is likely to fragment a little bit, too, giving smaller and perhaps independent players a chance to make an impact, especially in lending outside of the QM-defined box.

It’s going to be an interesting ride in 2014, regardless. And at HousingWire, we’re looking forward to covering every twist and turn, every loop, every climb and every dive.