Real estate internet companies grabbed the attention of investors Thursday after a negative report on Zillow (Z) rattled the market.

It began when Morgan Stanley (MS) analyst Scott Devitt downgraded Zillow's rating from 'equal weight' to underweight, while raising the price target from $66 to $70, StreetInsider reported.

While real estate advertising online is a fast growing segment, it’s still not as effective as word of mouth, Devitt reportedly argued in his report.

Devitt's analysis suggested many agents still obtain most of their new business from referrals and word of mouth, with real estate professionals even rating online advertising behind newspapers.

Additionally, market saturation could slow growth for the company. Put simply, the amount of product provided to the market may be maximized in the current marketplace, Devitt's report said.

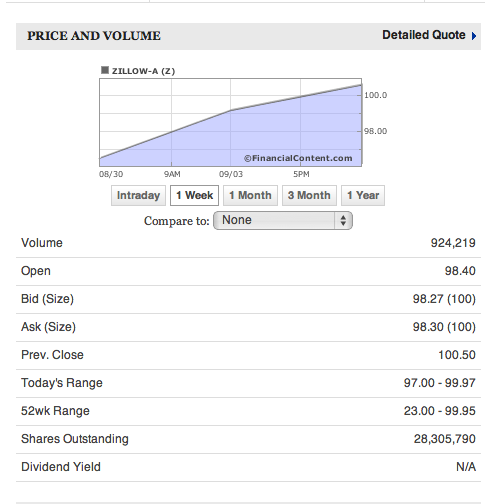

Investors reacted to the downgrade, with Zillow's stock down 2.24% at market close, with shares closing at $98.

However, when taking a closer look at the HW 30 index — HousingWire’s exclusive index of housing industry stocks — Zillow outperformed for the week, reaching more than $100 per share. In fact, another analyst sent Zillow soaring in trading on Wednesday.

As of Wednesday, both Trulia and Zillow reached highs on momentum from a bullish research report released by stock analyst Chad Bartley with Pacific Crest Securities. Investor’s Business Daily covered Bartley’s note in full. In it, he rates Zillow as outperform or buy, the publication said.

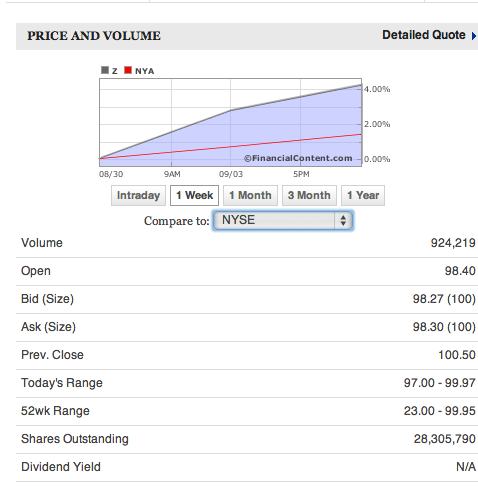

The chart's below track Zillow's performance throughout the week and on Thursday.

When comparing Zillow to other stocks trading on the New York Stock Exchange Thursday, the company has outperformed for the week, seeing more than 4% growth.

Click here to read the full report.